- In the dynamic world of finance, forex trading stands out as a lucrative avenue for income generation. The Foreign Exchange market, with its daily trading volume surpassing $6 trillion, offers ample opportunities for traders to profit from fluctuations in currency pairs. Among the myriad approaches within Forex trading, options trading emerges as a sophisticated strategy for income generation. Let’s delve into the world of Forex options trading, exploring strategies, tips, and key takeaways for aspiring traders.

Understanding Forex Options Trading

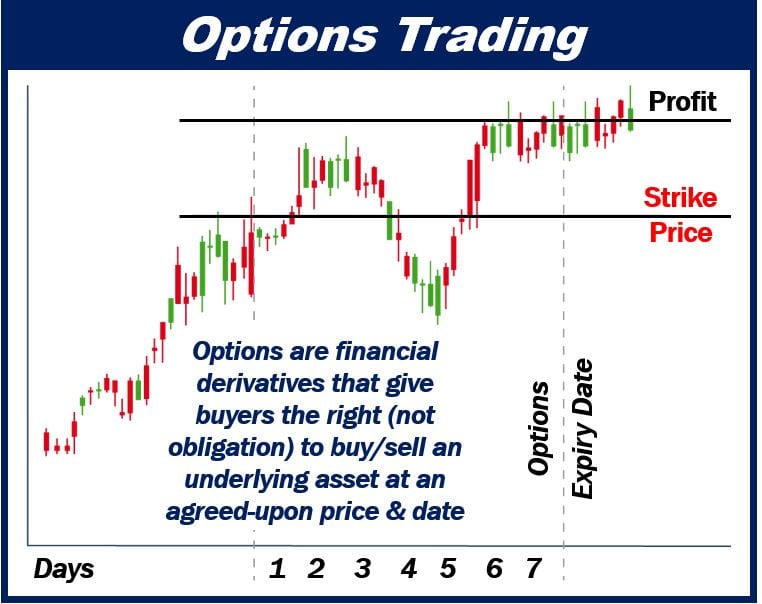

- Forex options trading grants traders the right, but not the obligation, to buy or sell a specific currency pair at a predetermined price within a specified time frame. Unlike spot trading, where traders execute trades immediately at prevailing market prices, options trading allows for more strategic maneuvers, capitalizing on price movements while mitigating risks.

Strategies for Income Generation

Covered Call Strategy

- This strategy involves holding a long position in a currency pair while simultaneously selling a call option on the same pair. Traders generate income from the premiums received from selling the call option, providing downside protection if the currency pair’s price declines.

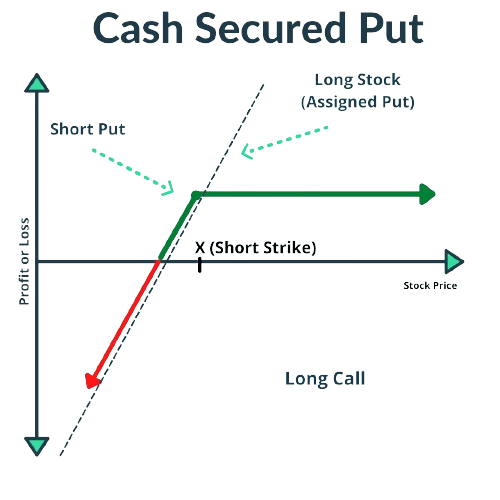

Cash-Secured Put Strategy

- In this approach, traders sell put options on currency pairs they are willing to buy at a predetermined price (strike price). By receiving premiums for selling the put options, traders generate income while potentially acquiring the currency pair at a discount if the price falls below the strike price.

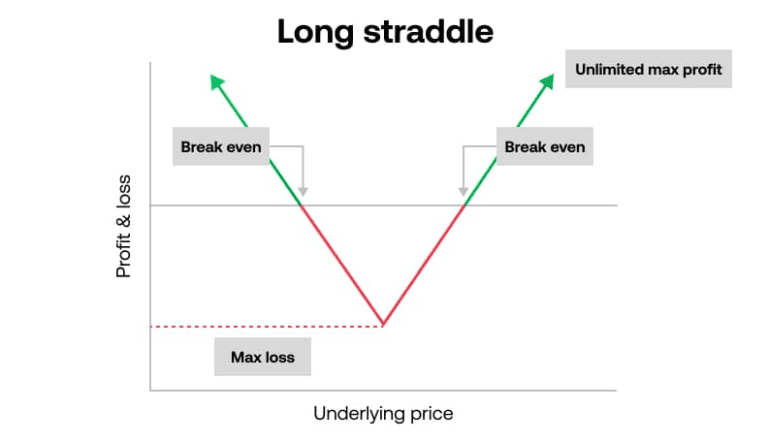

Straddle Strategy

- This strategy involves purchasing both a call option and a put option on the same currency pair with the same strike price and expiration date. Traders employ this strategy when they anticipate significant price volatility, aiming to profit from large price swings in either direction.

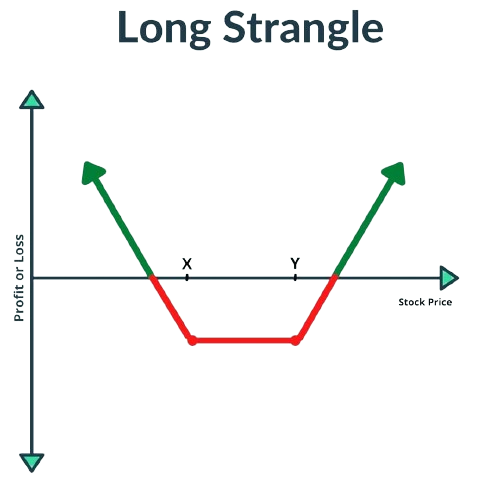

Strangle Strategy

- Similar to the straddle strategy, the strangle strategy involves buying out-of-the-money call and put options simultaneously. Traders use this strategy to capitalize on potential price fluctuations while reducing the cost of entering the trade compared to a straddle.

Tips for Successful Forex Options Trading

- Risk Management: Implementing robust risk management strategies is paramount in Forex options trading. Set strict stop-loss levels to limit potential losses and diversify your options portfolio to spread risk across different currency pairs and strategies.

- Stay Informed: Keep abreast of geopolitical events, economic indicators, and central bank policies that can influence currency markets. Utilize fundamental and technical analysis to identify potential trading opportunities and make informed decisions.

- Practice Patience: Forex options trading requires patience and discipline. Avoid chasing trades or succumbing to emotional impulses. Wait for favorable setups and adhere to your trading plan rigorously.

- Continuous Learning: The Forex market is ever-evolving, so commit to continuous learning and skill development. Stay updated on industry trends, attend seminars/webinars, and leverage educational resources provided by reputable brokers and trading platforms.

Key Takeaways

- Diversify Your Strategies: Explore a variety of options trading strategies to adapt to different market conditions and maximize profit potential while minimizing risk.

- Embrace Risk Management: Prioritize risk management to safeguard your capital and preserve long-term profitability. Avoid overleveraging and always have a predefined exit strategy in place.

- Stay Disciplined: Develop a disciplined approach to trading, adhering to your trading plan and resisting impulsive decisions driven by emotions.

- Seek Education: Invest in your trading education and stay informed about market developments to sharpen your skills and gain a competitive edge in Forex options trading.