- In the fast-paced realm of Forex trading, staying ahead of market trends is crucial for success. While the Forex market is known for its volatility and unpredictability, traders can gain a competitive edge by utilizing trend-following indicators. These indicators provide valuable insights into market direction, helping traders identify profitable opportunities and minimize risks. In this blog, we explore the significance of trend-following indicators in Forex trading, including the Trendometer indicator, and uncover key takeaways for traders looking to enhance their strategies.

Understanding Trend-Following Indicators:

- Trend-following indicators are technical tools used by traders to identify the direction and strength of market trends. These indicators analyze historical price data and generate signals based on moving averages, momentum, and other mathematical calculations. By recognizing patterns and trends in price movements, traders can make informed decisions about when to enter or exit trades, maximizing profits and minimizing losses.

Some of the most popular trend-following indicators used in Forex trading include:

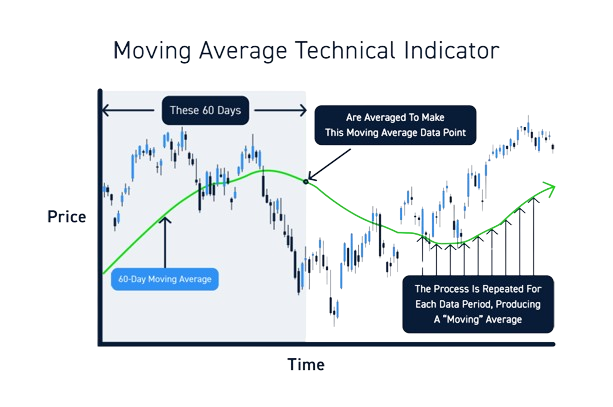

1. Moving Averages

- Moving averages smooth out price fluctuations and provide a visual representation of the underlying trend. Traders often use the crossover of different moving averages, such as the 50-day and 200-day moving averages, to signal potential trend reversals or continuations.

2. Relative Strength Index (RSI)

- The RSI measures the magnitude of recent price changes to determine whether a currency pair is overbought or oversold. Traders interpret RSI readings above 70 as overbought conditions, indicating a potential reversal, while readings below 30 suggest oversold conditions and a possible buying opportunity.

3. MACD (Moving Average Convergence Divergence)

- The MACD combines two moving averages to identify changes in trend momentum. Traders look for bullish or bearish crossovers between the MACD line and the signal line to confirm buy or sell signals.

4. Trendometer Indicator

- The Trendometer indicator is a tool that provides a clear indication of whether the market is trending upwards or downwards. It measures the strength of the current trend by analyzing price movements and can help traders identify the most favorable trading opportunities.

Key Takeaways

- 1. Identify Market Trends : Trend-following indicators help traders identify the direction of market trends, whether they are bullish, bearish, or ranging. By aligning their trades with the prevailing trend, traders increase the probability of success and reduce the risk of trading against the market.

- 2. Use Multiple Indicators for Confirmation : While trend-following indicators can provide valuable insights, they are not infallible. Traders should consider using multiple indicators or combining different types of indicators to confirm signals and filter out false signals.

- 3. Practice Risk Management : Despite their predictive capabilities, trend-following indicators do not guarantee success in Forex trading. Traders must implement proper risk management techniques, such as setting stop-loss orders and managing position sizes, to protect their capital and minimize losses.

- 4. Adapt to Changing Market Conditions : Market trends can change rapidly, requiring traders to adapt their strategies accordingly. Stay informed about economic events, geopolitical developments, and other factors that may influence market sentiment and adjust your trading approach as needed.