- Forex trading offers lucrative opportunities for investors to profit from the fluctuations in currency exchange rates. However, with the potential for high returns comes inherent risks. Successful Forex traders understand the importance of implementing robust risk management strategies to protect their capital and optimize their chances of long-term success. In this blog, we'll explore practical risk management techniques tailored for Forex traders, along with key takeaways to help navigate the volatile currency markets effectively.

Risk Management Strategies for Forex Traders: A Practical Approach

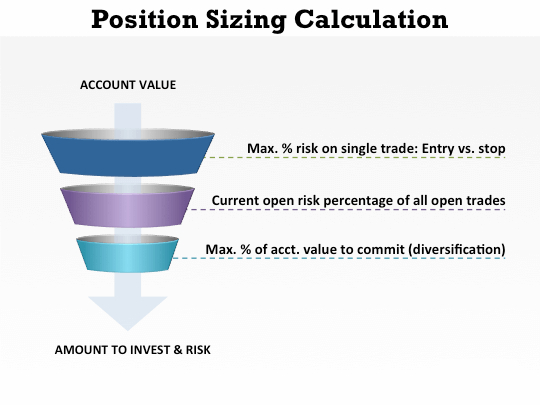

Position Sizing

- Position sizing is a fundamental aspect of risk management in Forex trading. It involves determining the appropriate size of each trade relative to your account balance and risk tolerance. A common rule of thumb is to risk only a small percentage of your trading capital on any single trade, typically ranging from 1% to 3%. By adhering to this rule, traders can limit their exposure to potential losses and preserve capital during periods of market volatility.

Stop Loss Orders

- Stop loss orders are essential tools for managing risk in Forex trading. These orders allow traders to specify a predetermined price level at which their positions will be automatically closed to limit losses. By setting stop loss orders at strategic levels based on technical analysis or support and resistance zones, traders can mitigate the impact of adverse market movements and protect their capital from significant drawdowns.

Diversification

- Diversification is a key principle of risk management that involves spreading your investment across multiple currency pairs and asset classes. By diversifying your portfolio, you can reduce the correlation between individual trades and minimize the impact of adverse events on your overall performance. Additionally, trading multiple currency pairs allows traders to capitalize on opportunities in different markets and increase their chances of generating consistent profits.

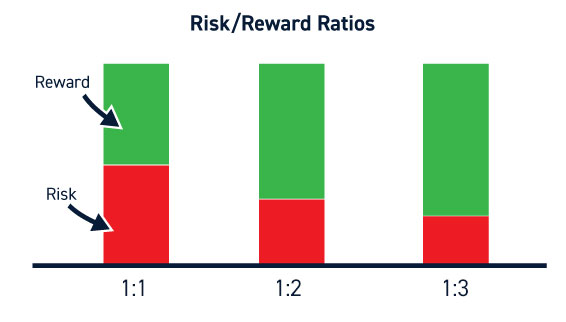

Risk-Reward Ratio

- The risk-reward ratio is a critical metric used by Forex traders to assess the potential profitability of a trade relative to its risk. A favorable risk-reward ratio typically involves aiming for higher potential rewards while keeping potential losses limited. For example, a risk-reward ratio of 1:2 means that for every dollar risked, the trader aims to make two dollars in profit. By adhering to a positive risk-reward ratio, traders can ensure that their winning trades outweigh their losing trades over the long term.

Key Takeaways

- 1. Preserve Capital : Protecting your trading capital should be the primary objective of any risk management strategy. By implementing position sizing, stop loss orders, and diversification, traders can minimize the impact of losses and preserve their capital for future trading opportunities.

- 2. Embrace Discipline : Successful Forex trading requires discipline and adherence to predefined risk management rules. Avoid emotional decision-making and stick to your risk management plan, even during periods of market uncertainty or volatility.

- 3. Continuously Evaluate and Adjust : The Forex market is dynamic and constantly evolving. Regularly review and adjust your risk management strategies based on changes in market conditions, performance metrics, and personal risk tolerance levels.