- Forex trading, short for foreign exchange trading, is a lucrative yet complex endeavor that offers individuals the opportunity to profit from the fluctuations in currency prices. With an estimated daily trading volume of over $6 trillion, the forex market is the largest financial market globally, providing ample opportunities for traders to capitalize on price movements. However, success in forex trading requires a combination of knowledge, strategy, and discipline. In this blog, we'll explore how to get started in forex trading and share some key takeaways for success.

Understanding the Basics

- Before diving into forex trading, it's crucial to understand the basics of how the market operates. At its core, forex trading involves buying one currency while simultaneously selling another currency. Currencies are traded in pairs, with the most commonly traded pairs being EUR/USD, USD/JPY, and GBP/USD.

Get Educated

- One of the first steps to success in forex trading is to educate yourself about the market. There are numerous online resources, courses, and books available that cover everything from the fundamentals of forex trading to advanced trading strategies. Take the time to learn about technical analysis, fundamental analysis, risk management, and trading psychology.

Choose a Reliable Broker

- Selecting the right forex broker is essential for your success as a trader. Look for a broker that is regulated by a reputable financial authority, offers competitive spreads, has a user-friendly trading platform, and provides access to a wide range of currency pairs. Additionally, consider factors such as customer support, deposit and withdrawal methods, and trading tools and resources.

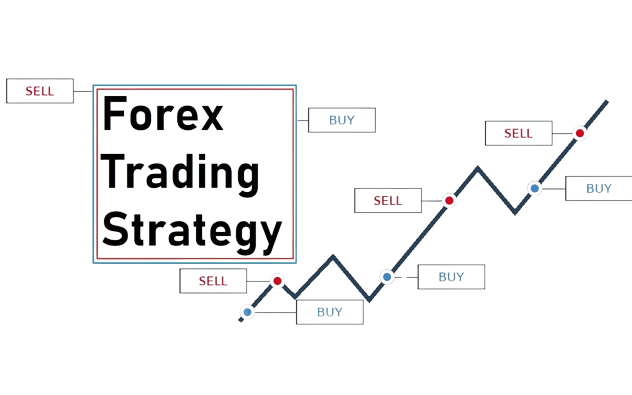

Develop a Trading Strategy

- Successful forex trading requires a well-thought-out trading strategy. Your strategy should outline your approach to analyzing the market, entering and exiting trades, managing risk, and achieving your trading goals. Whether you prefer scalping, day trading, swing trading, or position trading, it's essential to stick to a strategy and avoid making impulsive decisions based on emotions.

Practice with a Demo Account

- Before risking real money, it's advisable to practice trading with a demo account. Most forex brokers offer demo accounts that allow you to trade with virtual money in real market conditions. Use this opportunity to test different trading strategies, familiarize yourself with the trading platform, and gain confidence in your abilities as a trader.

Manage Risk Effectively

- Risk management is a crucial aspect of forex trading that often separates successful traders from unsuccessful ones. Never risk more than you can afford to lose on a single trade, and use stop-loss orders to limit your losses. Additionally, consider the size of your positions relative to your account balance, and diversify your trades to spread risk across different currency pairs.

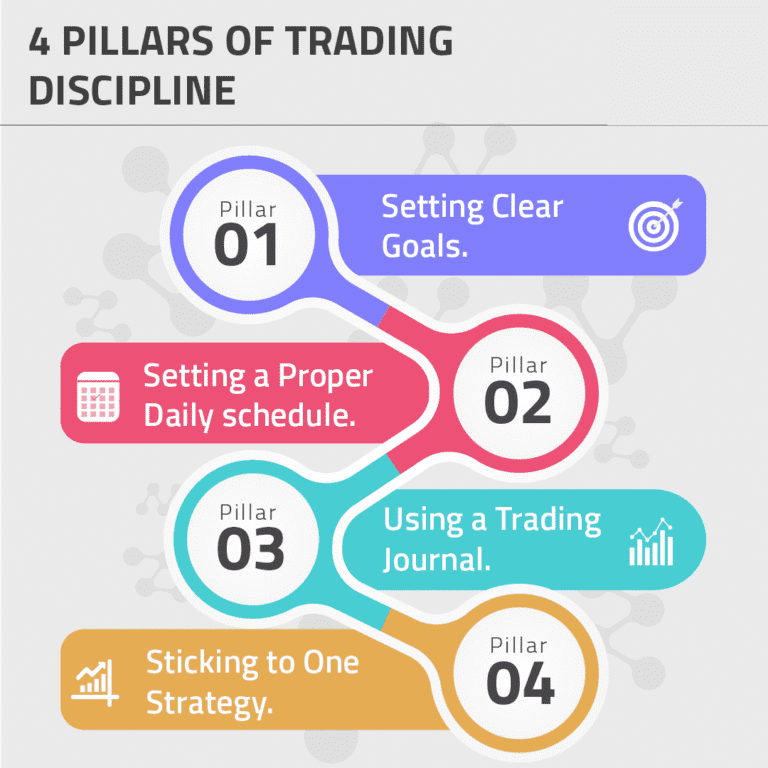

Stay Disciplined

- Discipline is key to long-term success in forex trading. Stick to your trading plan, even when faced with temptation to deviate from it. Avoid chasing losses or letting emotions dictate your trading decisions. Instead, approach trading with patience, consistency, and a rational mindset.

Keep Learning and Adapting

- The forex market is constantly evolving, so it's essential to stay informed and adapt your trading strategies accordingly. Continuously educate yourself about market developments, economic indicators, and geopolitical events that may impact currency prices. Keep a trading journal to track your performance and learn from both your winning and losing trades.

Key Takeaways

- 1. Educate yourself about the forex market and trading strategies.

- 2. Choose a reliable broker that meets your trading needs.

- 3. Develop a trading strategy and stick to it.

- 4. Practice trading with a demo account before risking real money.

- 5. Manage risk effectively and stay disciplined in your trading approach.

- 6. Stay informed about market developments and adapt your strategies accordingly.