Introduction to NFTs

- Non-Fungible Tokens (NFTs) have surged in popularity as a form of digital asset representing ownership or proof of authenticity of unique items or content on the blockchain. Unlike cryptocurrencies such as Bitcoin or Ethereum, NFTs are indivisible and cannot be exchanged on a like-for-like basis.

Understanding NFTs

- NFTs can represent a wide range of digital and physical assets, including art, music, videos, virtual real estate, and collectibles. Each NFT is unique and has its own distinct value, determined by factors such as scarcity, demand, and the reputation of the creator.

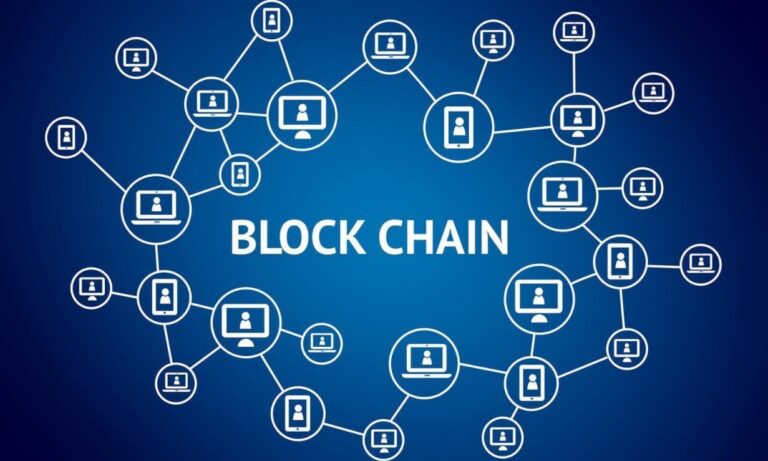

The Role of Blockchain Technology

- Blockchain technology underpins NFTs, providing a transparent and immutable ledger of ownership and transaction history. This ensures authenticity and prevents unauthorized duplication or forgery of digital assets.

Investing in NFTs

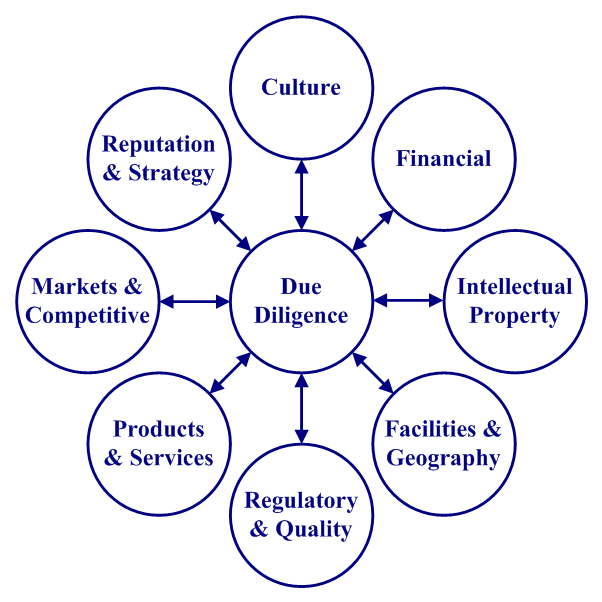

Research and Due Diligence

- Before investing in NFTs, it's essential to conduct thorough research on the asset, its creator, and the platform hosting the NFT. Understanding the market demand and potential future value of the asset is crucial.

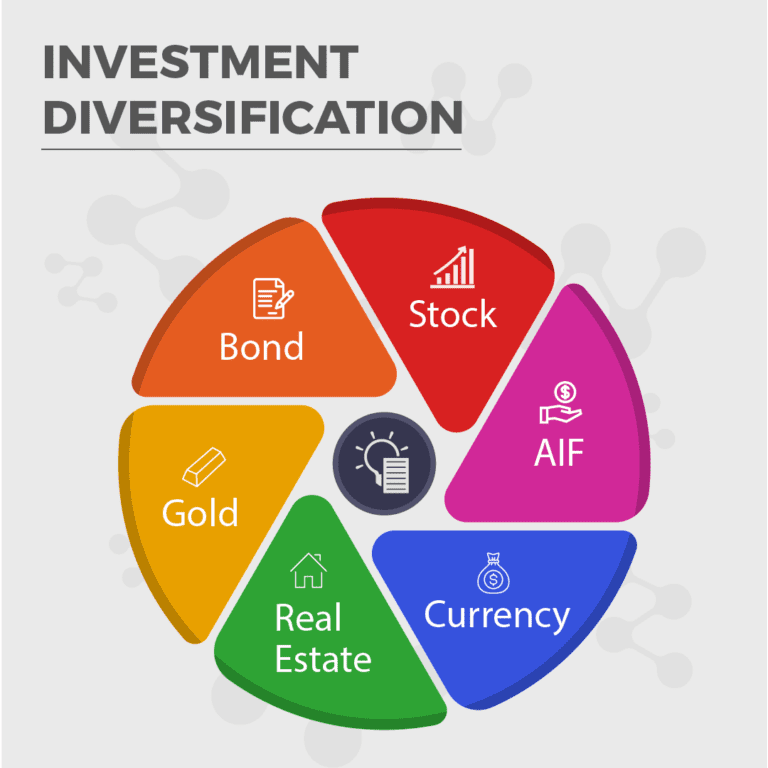

Diversification

- Like any investment, diversification is key to managing risk. Investors should consider diversifying their NFT portfolio across different types of assets and creators to mitigate concentration risk.

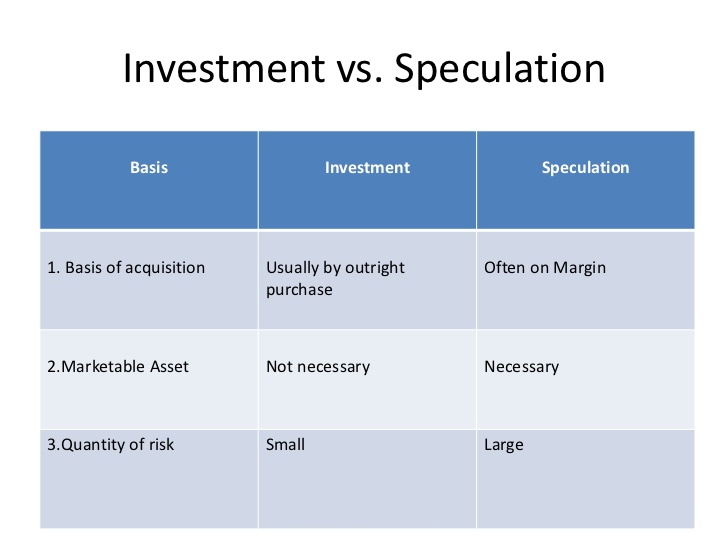

Long-Term Value vs. Speculation

- Some NFTs may have long-term value due to their rarity, historical significance, or cultural relevance. However, others may be speculative in nature, driven primarily by hype or trends. It's important for investors to distinguish between the two and invest accordingly.

Storage and Security

- NFTs are stored in digital wallets, which require robust security measures to protect against theft or loss. Investors should choose reputable wallets and implement best practices for securing their digital assets.

Market Volatility

- The NFT market can be highly volatile, with prices fluctuating rapidly based on market sentiment and demand. Investors should be prepared for price fluctuations and exercise caution when entering and exiting positions.

Risks and Challenges

Market Volatility

- The NFT market is highly speculative and prone to price volatility. Investors should be prepared for significant price swings and the potential for loss.

Regulatory Uncertainty

- The regulatory landscape surrounding NFTs is still evolving, with potential implications for investors. It's essential to stay informed about regulatory developments and comply with applicable laws and regulations.

Liquidity Risk

- NFTs can be illiquid assets, meaning they may not be easily bought or sold at desired prices. Investors should be mindful of liquidity risk when investing in NFTs and consider their ability to exit positions if needed.

Conclusion

- Investing in NFTs offers exciting opportunities for diversification and potential returns, but it also comes with inherent risks and challenges. By conducting thorough research, diversifying their portfolios, and understanding the unique characteristics of NFTs, investors can navigate the market effectively and make informed investment decisions. As the NFT market continues to evolve, staying informed about market trends, technological advancements, and regulatory developments will be key to success in this rapidly growing space.