- In recent years, the world of finance has witnessed a paradigm shift with the rise of Decentralized Finance (DeFi) trading. Traditional financial systems are being challenged by decentralized alternatives that offer greater accessibility, transparency, and autonomy to traders and investors. Forex trading, in particular, has seen a significant impact from the advent of DeFi, opening up new avenues for profit and innovation. In this blog, we'll delve into the world of DeFi trading and explore the opportunities it presents for forex traders.

Understanding DeFi Trading:

- DeFi trading refers to the use of decentralized platforms and protocols to conduct financial transactions without the need for intermediaries such as banks or brokerages. These platforms are built on blockchain technology, which ensures transparency, security, and immutability of transactions. Unlike traditional financial systems, where central authorities control the flow of capital, DeFi allows users to directly interact with smart contracts, enabling peer-to-peer trading and lending.

Opportunities in DeFi Forex Trading:

24/7 Trading

- One of the most significant advantages of DeFi forex trading is its accessibility. Unlike traditional forex markets that operate within specific hours, decentralized platforms are open 24/7, allowing traders from around the world to participate at any time. This eliminates the need to wait for market openings and enables traders to capitalize on opportunities as they arise.

Liquidity Pooling

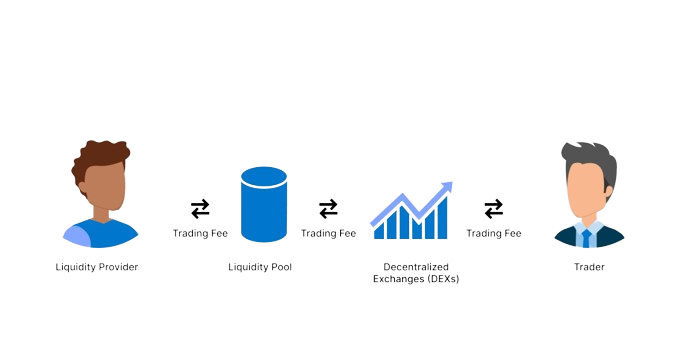

- DeFi platforms often utilize liquidity pools, where users can contribute their assets to provide liquidity for trading pairs. This system ensures continuous liquidity and allows traders to execute trades quickly without significant price slippage. Forex traders can leverage these liquidity pools to access a wide range of currency pairs with minimal friction.

Automated Trading Strategies

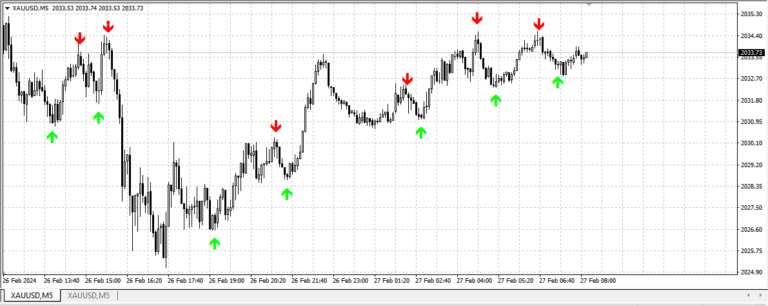

- DeFi platforms offer programmable smart contracts that enable the automation of trading strategies. Traders can create customized algorithms to execute trades based on predefined conditions, such as price movements or market indicators. This automation not only saves time but also removes human emotions from the trading process, leading to more disciplined and consistent results.

Decentralized Exchanges (DEXs)

- DEXs facilitate peer-to-peer trading without the need for intermediaries. These platforms allow users to trade directly from their wallets, ensuring greater security and control over their funds. Additionally, DEXs often have lower fees compared to centralized exchanges, making them more cost-effective for traders.

Yield Farming and Staking

- DeFi platforms offer various opportunities for yield farming and staking, where users can earn rewards by providing liquidity or holding specific assets. Forex traders can utilize these strategies to generate passive income while diversifying their investment portfolios. However, it's essential to conduct thorough research and assess the risks associated with each opportunity.

Key Takeaways

- 1. Diversification: DeFi trading offers forex traders the opportunity to diversify their portfolios beyond traditional assets. By exploring decentralized platforms, traders can access a wide range of digital assets and investment opportunities.

- 2. Risk Management: While DeFi trading presents lucrative opportunities, it's essential to exercise caution and implement robust risk management strategies. Due diligence is crucial when selecting platforms and executing trades to mitigate the potential for losses.

- 3. Education: As with any form of trading, education is key to success in DeFi trading. Traders should stay informed about market trends, technological advancements, and regulatory developments to make informed decisions.

- 4. Adaptability: The landscape of DeFi trading is constantly evolving, with new protocols and innovations emerging regularly. Traders must remain adaptable and open to learning to stay ahead of the curve and capitalize on emerging opportunities.