- In the dynamic world of forex trading, seasoned traders know that the key to success lies not only in understanding market trends but also in deciphering the intriguing concept of stock market seasonality. This phenomenon refers to recurring patterns and trends that tend to repeat themselves during specific periods throughout the year, providing valuable insights for traders looking to capitalize on market movements.

What is Stock Market Seasonality?

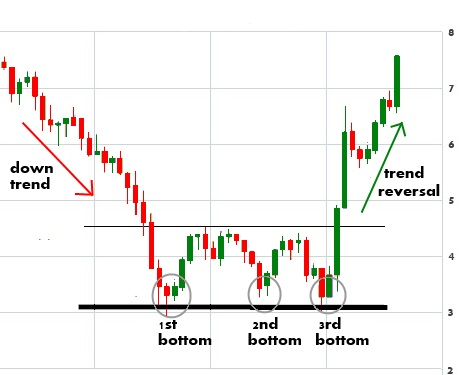

- Stock market seasonality is the study of price patterns, trends, and behaviors that occur at certain times of the year. Traders analyze historical data to identify recurring trends during specific seasons, months, or even days of the week. Understanding these patterns can help traders make informed decisions and adjust their strategies accordingly.

The Problem of Seasonality in the Stock Market

- While seasonality can provide valuable insights, it's crucial to acknowledge that it's not foolproof. Markets are influenced by a multitude of factors, and relying solely on historical patterns may lead to missed opportunities or unexpected challenges. However, incorporating seasonality into your trading strategy can be a valuable tool when used in conjunction with other analytical methods.

The Summer Effect: “Sell in May and Go Away”

- One of the well-known seasonal patterns in the stock market is the "Sell in May and Go Away" phenomenon. Historically, stock markets have exhibited weaker performance during the summer months, prompting some investors to liquidate their positions in May and return to the market in the fall. This pattern is attributed to reduced trading activity during the vacation season, leading to lower liquidity and potentially increased volatility.

The Santa Claus Rally

- On a more festive note, the "Santa Claus Rally" is a phenomenon observed in the last week of December. This period often sees an uptick in stock prices, attributed to holiday optimism, increased consumer spending, and a generally positive market sentiment as the year comes to a close. Traders may position themselves to benefit from this seasonal surge in market activity.

The Market Holiday Effect

- Market holidays can have a significant impact on trading patterns. During holidays, trading volumes tend to be lower, and markets may experience increased volatility as a result. Traders should be mindful of market closures and plan their strategies accordingly to navigate potential price fluctuations.

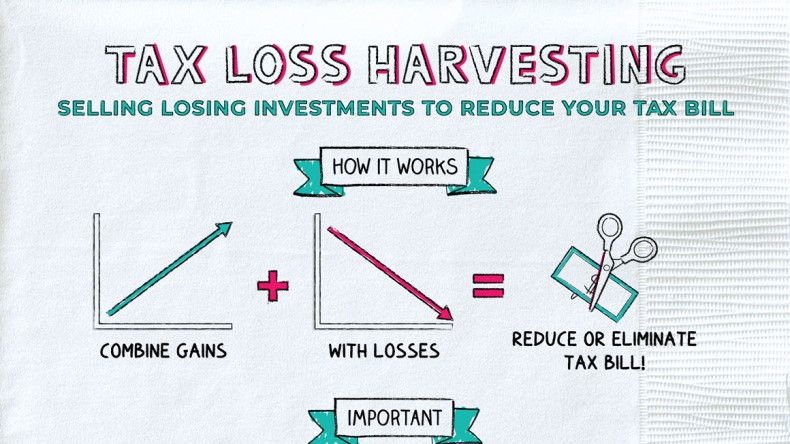

Tax Loss Harvesting/Selling Seasonality

- The end of the calendar year brings a unique aspect of seasonality known as tax loss harvesting. Investors may strategically sell underperforming assets to offset capital gains and reduce their tax liabilities. This selling seasonality can create opportunities for traders to enter the market or adjust their portfolios based on the anticipated fluctuations in asset prices.

Bottom Line

- In conclusion, understanding stock market seasonality adds another layer of depth to a trader's analytical toolkit. While not a crystal ball, recognizing and incorporating these seasonal patterns can provide valuable insights into potential market movements. However, it's essential to approach seasonality as one of many factors influencing the market, combining it with thorough research, technical analysis, and a comprehensive trading strategy.