- Forex trading, often hailed as one of the most lucrative forms of investment, thrives on a multitude of intricate concepts and metrics. Among these, the term "pips" stands out as a fundamental unit of measurement, wielding significant influence over traders' decisions and strategies. In this blog, we will delve into the concept of pips, elucidate how to determine their worth, and explore essential materials to enhance your understanding of forex trading.

Understanding Pips

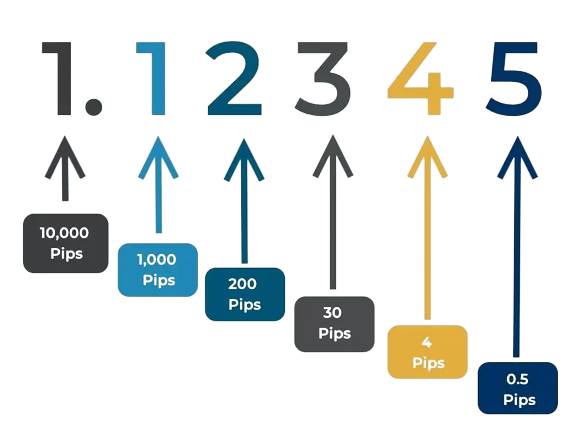

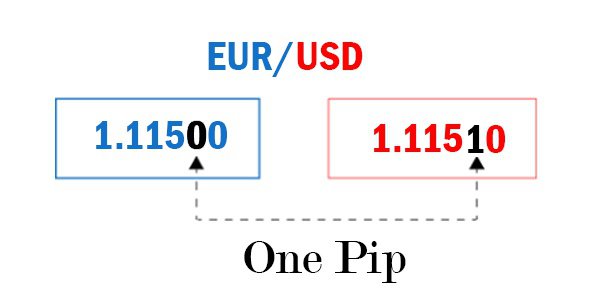

- "Pip" stands for "Percentage in Point" or "Price Interest Point," and it represents the smallest price movement that a currency exchange rate can make. In essence, pips serve as the basic unit of measurement for expressing changes in currency value. For most currency pairs, a pip is equivalent to 0.0001, except for pairs involving the Japanese Yen, where it is 0.01. For instance, if the EUR/USD currency pair moves from 1.2000 to 1.2001, it has risen by one pip. Conversely, if it moves from 1.2000 to 1.1999, it has decreased by one pip.

Determining the Worth of a Pip

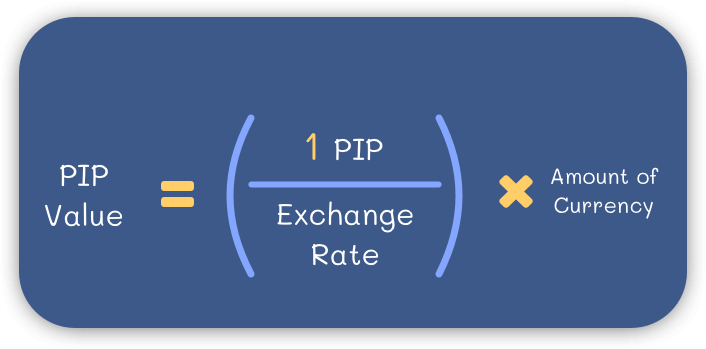

- The worth of a single pip is determined by the size of the position taken in the market and the currency pair being traded. To calculate the value of a pip in your account currency, you can use the following formula: Value of a Pip = (Pip in decimal places * Trade Size) / Market Price

Illustration Using EUR/USD Pips

- Let's consider trading one standard lot (100,000 units) of EUR/USD. With the current exchange rate at 1.2000 and a pip value of 0.0001, the value of one pip would be: Value of a Pip = (0.0001 * 100,000) / 1.2000 = $8.33 (approximately) This means that for every pip movement in the EUR/USD pair, your profit or loss would fluctuate by approximately $8.33.

Converting Pip Values

- It's essential to be able to convert pip values into your account currency to accurately assess potential profits or losses. Most trading platforms provide tools or calculators to facilitate this process, enabling traders to make informed decisions based on their risk tolerance and financial goals.

The Exception: USD/JPY Pips

- As mentioned earlier, the Japanese Yen is an exception in forex trading, where the pip value is expressed differently. For currency pairs involving the Japanese Yen, such as USD/JPY, a pip is equivalent to 0.01 due to the lower value of the Yen compared to other major currencies.

Additional Materials for Understanding Forex Trading:

- To delve deeper into the world of forex trading and hone your skills, there are various resources available:

1. Educational Websites

- Numerous online platforms offer comprehensive guides, tutorials, and articles covering all aspects of forex trading, from basic principles to advanced strategies.

2. Books

- There are countless books written by experienced traders and industry experts that provide valuable insights and practical advice for traders of all levels.

3. Webinars and Seminars

- Attending webinars or seminars hosted by reputable forex brokers or trading professionals can offer valuable insights, tips, and strategies to enhance your trading knowledge and skills.

4. Demo Accounts

- Practicing on demo accounts provided by forex brokers allows you to trade in real market conditions without risking real money, providing an excellent opportunity to test strategies and refine your trading skills.

Conclusion

- In conclusion, understanding the concept of pips and their worth is crucial for success in forex trading. By grasping the fundamentals of pips, calculating their value, and exploring additional materials, traders can make informed decisions and develop effective trading strategies. Whether you're a novice or experienced trader, continuous learning and staying abreast of market developments are key to navigating the dynamic world of forex trading with confidence and proficiency.