- Forex trading the world's largest financial market, offers immense opportunities for profit and growth. However, navigating this dynamic landscape requires skill, knowledge, and careful consideration of various factors. Among these factors, forex indicators play a crucial role in guiding trading decisions. Yet, many traders fall into common pitfalls when using these indicators. Let's explore some of these mistakes and key takeaways to enhance your trading experience.

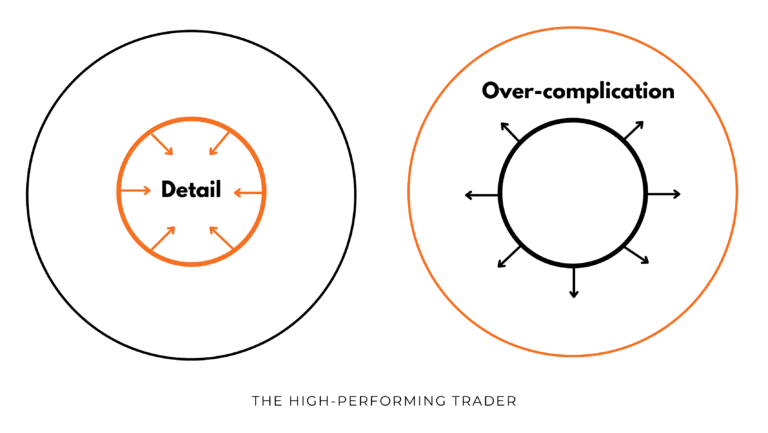

Mistake 1: Overcomplicating Strategies

- One common mistake traders make is overcomplicating their trading strategies with an excessive number of indicators. While indicators can provide valuable insights into market trends and potential entry and exit points, using too many of them can lead to confusion and indecision. Instead, focus on a select few indicators that align with your trading style and objectives. Keep your strategy simple and streamlined for better clarity and effectiveness.

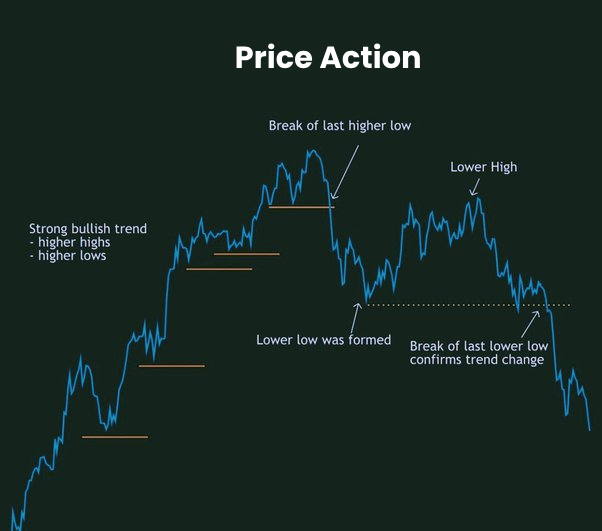

Mistake 2: Ignoring Price Action

- Another mistake is relying solely on indicators without considering price action. Price action, or the movement of a currency pair's price over time, provides valuable information about market sentiment and momentum. Indicators should complement price action analysis rather than replace it. Pay attention to key support and resistance levels, chart patterns, and candlestick formations to enhance your trading decisions and avoid being overly reliant on indicators alone.

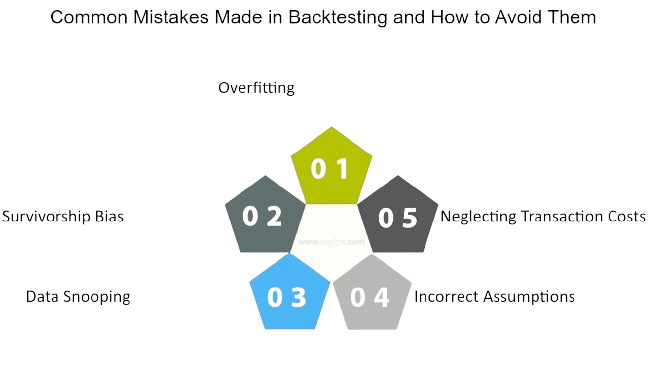

Mistake 3: Neglecting to Backtest Indicators

- Failing to backtest indicators before using them in live trading is a critical mistake. Backtesting involves testing a trading strategy or indicator using historical market data to assess its performance and effectiveness. By conducting thorough backtesting, you can identify strengths and weaknesses, optimize parameters, and gain confidence in your trading approach. Neglecting this step can lead to unexpected losses and missed opportunities in the live market.

Mistake 4: Disregarding Market Conditions

- Ignoring current market conditions is another common pitfall. Market conditions, such as volatility, liquidity, and economic events, can significantly impact the effectiveness of indicators. What works well in a trending market may not perform as expected in a ranging or choppy market. Take the time to assess market conditions and adjust your trading strategy and indicator settings accordingly to adapt to changing environments.

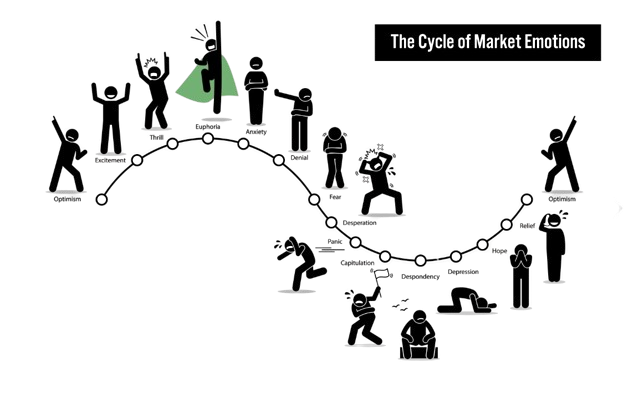

Mistake 5: Emotional Trading

- Emotional trading often leads to poor decision-making and impulsive actions. Fear, greed, and FOMO (fear of missing out) can cloud judgment and cause traders to deviate from their trading plan. It's essential to remain disciplined and objective when using indicators to guide your trading decisions. Stick to your predefined risk management rules, set realistic profit targets, and avoid letting emotions dictate your actions.

Key Takeaways

- 1. Keep your trading strategy simple and avoid overcomplicating it with too many indicators.

- 2. Use indicators in conjunction with price action analysis to make informed trading decisions.

- 3. Conduct thorough backtesting of indicators to assess their performance and optimize parameters.

- 4. Consider current market conditions and adjust your trading approach accordingly to adapt to changing environments.

- 5. Practice disciplined and objective trading to avoid emotional pitfalls and stick to your trading plan.