- Forex trading, or foreign exchange trading, involves the exchange of currencies on a global scale. It's a dynamic market, continuously influenced by geopolitical events, economic data, and various other factors. For traders, the ability to adapt and employ different strategies to capitalize on these fluctuations is essential. One of the most effective ways to navigate the complexities of forex trading is through algorithmic trading. In this blog, we’ll explore several key algorithmic strategies suitable for different market conditions, including trend-following algorithms, arbitrage strategies, mean reversion trading, and customizing algorithms for volatile markets.

Algo Trading Strategies for Different Market Conditions

- Algorithmic trading, or algo trading, uses pre-programmed instructions to execute trades based on various market indicators. These algorithms can analyze vast amounts of data at speeds beyond human capability, making them invaluable in the fast-paced forex market. The primary advantage of algo trading is its ability to maintain discipline and consistency, eliminating emotional bias. Let’s dive into specific strategies.

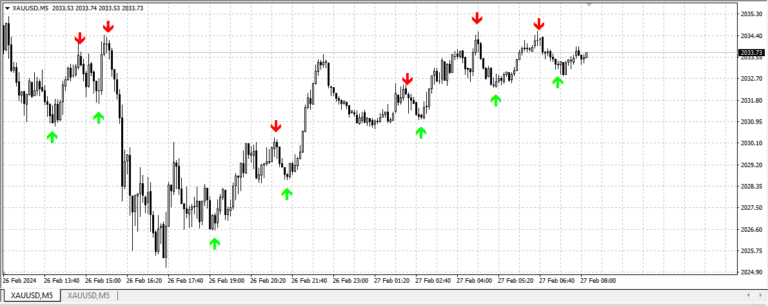

Trend Following Algorithms

- Trend following is a popular strategy in forex trading, based on the idea that prices tend to move in trends. Trend-following algorithms identify and capitalize on these trends, whether they are upward (bullish) or downward (bearish). These algorithms typically use indicators such as moving averages, Bollinger Bands, and the Relative Strength Index (RSI) to identify entry and exit points.

- For example, a simple moving average crossover system can be an effective trend-following strategy. This involves two moving averages of different periods. When the shorter-term moving average crosses above the longer-term moving average, it signals a buy. Conversely, when it crosses below, it signals a sell.

Arbitrage Strategies Explained

- Arbitrage strategies exploit price discrepancies between different markets or instruments. In forex trading, this often involves simultaneously buying and selling currency pairs in different markets to profit from price differences. There are various forms of arbitrage in forex, including:

- Spatial Arbitrage : Exploiting price differences in different geographical markets.

- Triangular Arbitrage : Involves three different currencies. If currency A is overvalued relative to currency B, and currency B is overvalued relative to currency C, an arbitrageur might exchange currency A for B, then B for C, and finally C for A, profiting from the discrepancies.

- Arbitrage opportunities are typically short-lived, requiring high-speed execution and advanced algorithms to capitalize on them before the market corrects itself.

Mean Reversion Trading

- Mean reversion is based on the idea that asset prices will revert to their historical mean or average over time. In forex, this could mean that a currency pair that has deviated significantly from its historical average will eventually move back towards it.

- Mean reversion trading algorithms identify overbought or oversold conditions and execute trades accordingly. Common indicators used in mean reversion strategies include Bollinger Bands, the RSI, and moving averages. For instance, if a currency pair is trading significantly above its moving average, a mean reversion strategy might involve selling the pair, anticipating a price drop back to the average.

Customizing Algorithms for Volatile Markets

- Volatility in the forex market can present both risks and opportunities. Customizing algorithms to adapt to volatile conditions can enhance trading performance. Key considerations include:

- Volatility Indicators : Algorithms can incorporate volatility indicators like the Average True Range (ATR) or Bollinger Bands to gauge market volatility and adjust trading parameters accordingly.

- Dynamic Position Sizing : Adjusting the size of trades based on volatility can help manage risk. In highly volatile markets, reducing position sizes can mitigate potential losses.

- Stop-Loss and Take-Profit Adjustments : Volatile markets may require wider stop-loss and take-profit levels to avoid premature exits due to market noise.

- Arbitrage opportunities are typically short-lived, requiring high-speed execution and advanced algorithms to capitalize on them before the market corrects itself.

Key Takeaways

- 1. Trend Following Algorithms : Utilize indicators like moving averages to capitalize on market trends.

- 2. Arbitrage Strategies : Exploit price discrepancies across different markets or instruments for profit.

- 3. Mean Reversion Trading : Identify overbought or oversold conditions, anticipating a return to historical averages.

- 4. Customizing for Volatilityt : Adapt algorithms with volatility indicators, dynamic position sizing, and adjusted stop-loss/take-profit levels.