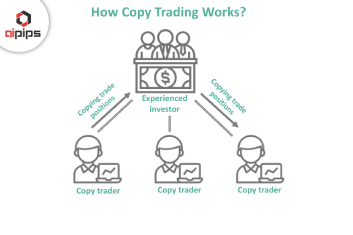

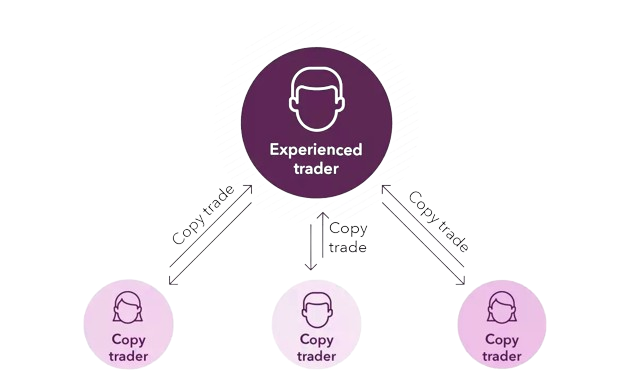

- Forex trading can be complex and intimidating for newcomers, but copy trading offers a practical entry point. By copying the trades of experienced traders, you can bypass much of the initial learning curve and still benefit from the potential gains in the forex market. Here’s a comprehensive guide to get you started.

Setting Up Your Copy Trading Account

1. Choose a Reliable Platform

- The first step is to select a reputable copy trading platform. Some of the popular ones include eToro, ZuluTrade, and Myfxbook. Ensure the platform is regulated and has positive user reviews.

2. Create an Account

- Sign up for an account on your chosen platform. You'll need to provide personal information and verify your identity, a standard procedure for financial services.

3. Deposit Funds

- After setting up your account, the next step is to deposit funds. Most platforms have a minimum deposit requirement, typically ranging from $200 to $500.

Finding and Evaluating Top Traders

1. Use Platform Filters

- Most copy trading platforms have filters that allow you to sort traders based on various criteria like profitability, risk level, trading frequency, and more. Utilize these filters to narrow down your options.

2. Analyze Performance Metrics

- Look at key performance metrics such as historical performance, drawdown, win rate, and average return per trade. These metrics will give you an insight into the trader’s consistency and risk management.

3. Review Trading Strategy

- Each trader usually has a profile detailing their trading strategy. Make sure their approach aligns with your risk tolerance and financial goals.

4. Check Reviews and Ratings

- Many platforms allow followers to rate and review traders. These reviews can provide additional insight into the trader's reliability and performance under various market conditions.

Managing Your Copy Trading Portfolio

1. Diversify Your Portfolio

- Just like in traditional investing, diversification is key in copy trading. Instead of copying a single trader, spread your investments across multiple traders. This approach can mitigate risk and improve your chances of steady returns.

2. Monitor Performance Regularly

- Keep a close eye on the performance of the traders you are copying. Forex markets are dynamic, and a trader performing well today might not do so tomorrow. Regular monitoring allows you to make timely adjustments to your portfolio.

3. Set Stop-Loss Orders

- To protect your investment, set stop-loss orders. This feature automatically stops copying a trader if their losses exceed a certain amount, thereby limiting your potential losses.

4. Reinvest Profits

- Consider reinvesting your profits to compound your returns over time. However, always keep a portion of your profits as a safety net.

Tips for Long-Term Success in Copy Trading

1. Stay Informed

- Even though you’re copying trades, staying informed about the forex market trends and economic news can help you make better decisions about which traders to follow and when to make adjustments.

2. Be Patient

- Copy trading is not a get-rich-quick scheme. It requires patience and a long-term perspective. Avoid making impulsive decisions based on short-term performance fluctuations.

3. Manage Your Expectations

- Understand that losses are a part of trading. Aim for consistent, steady growth rather than unrealistic high returns.

4. Keep Learning

- Take the time to learn from the traders you follow. Analyze their trades and understand their strategies. Over time, this can improve your own trading knowledge and skills.

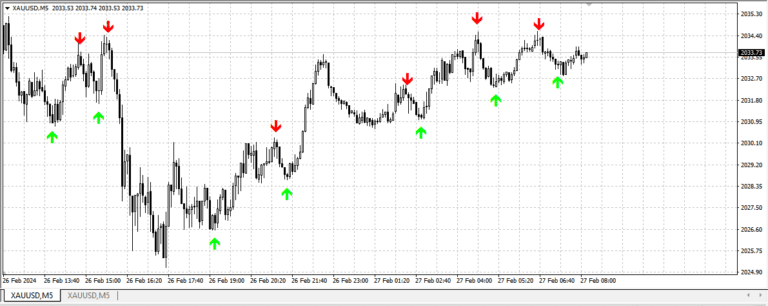

Leveraging the Trendometer Indicator from AIPips.com

- To further enhance your copy trading experience, consider incorporating tools like the Trendometer indicator from AIPips.com. The Trendometer is designed to help traders identify and follow market trends effectively, providing valuable insights that can complement your copy trading strategy.

1. Understand Market Trends

- The Trendometer can help you better understand the current market trends, allowing you to make more informed decisions about which traders to follow and when to adjust your portfolio.

2. Enhance Trader Selection

- Use the insights from the Trendometer to evaluate potential traders more effectively. For instance, if the Trendometer indicates a strong upward trend, you might favor traders who excel in bullish markets.

3. Optimize Portfolio Management

- Integrate the Trendometer's signals with your copy trading activities to optimize your portfolio management. This can help you identify when to increase or decrease your exposure to certain traders based on market conditions.

Key Takeaways

- 1. Ease of Entry : Copy trading is an excellent way for beginners to enter the forex market without extensive knowledge or experience.

- 2. Due Diligence is Crucial : Carefully selecting and evaluating traders to copy is vital for success.

- 3. Diversification Reduces Risk : Spreading your investments across multiple traders can help mitigate risk.

- 4. Regular Monitoring : Continually monitor the performance of copied traders and make necessary adjustments.

- 5. Long-Term Perspective : Patience and a long-term outlook are essential for consistent success in copy trading.

- 6. Utilize Advanced Tools : Leveraging tools like the Trendometer from AIPips.com can enhance your trading strategy by providing valuable market insights.