- In the realm of financial markets, forex trading stands out as one of the most dynamic and lucrative arenas. With its vast scope for profit and a plethora of strategies, forex trading, particularly through futures contracts, offers ample opportunities for those who are adept at navigating its complexities. Futures contracts, in particular, represent agreements to buy or sell assets at a predetermined price at a specified future date. In this blog, we delve into the strategies that can pave the path for success in forex trading through futures contracts.

Understanding Futures Contracts

- Before diving into strategies, it's essential to grasp the fundamentals of futures contracts. These contracts entail buying or selling a specified quantity of a financial instrument or commodity at a predetermined price on a specified date in the future. Unlike options contracts, futures contracts obligate the parties involved to fulfill the terms of the agreement. Forex futures contracts are standardized agreements traded on exchanges, offering traders a regulated environment to engage in currency trading.

Strategies for Success

Technical Analysis

- Utilizing technical analysis involves analyzing historical price data and chart patterns to forecast future price movements. Traders employ various indicators such as moving averages, Fibonacci retracements, and stochastic oscillators to identify entry and exit points. By interpreting price action and market trends, traders can make informed decisions about when to buy or sell futures contracts.

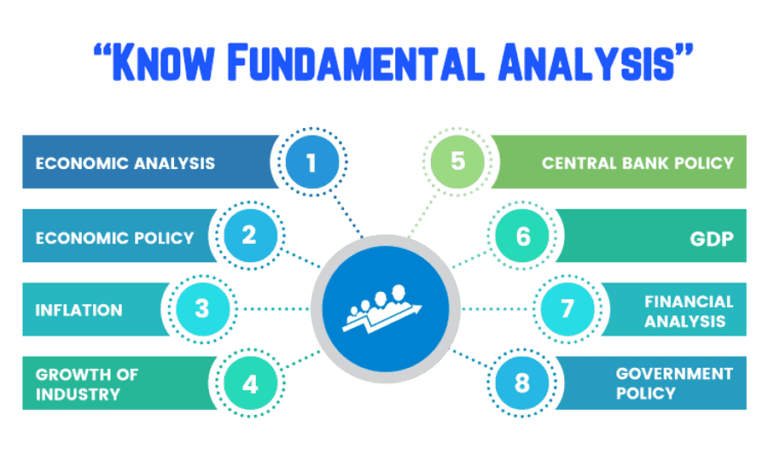

Fundamental Analysis

- In contrast to technical analysis, fundamental analysis focuses on economic indicators, geopolitical events, and monetary policies that influence currency prices. Traders assess factors such as interest rates, inflation rates, GDP growth, and central bank decisions to gauge the intrinsic value of currencies. By staying abreast of economic developments and their impact on currency markets, traders can anticipate market movements and position themselves accordingly.

Risk Management

- Effective risk management is paramount in forex trading to safeguard capital and mitigate losses. Traders employ various risk management techniques such as setting stop-loss orders, diversifying their portfolios, and adhering to strict position sizing rules. By limiting exposure to individual trades and maintaining a disciplined approach to risk management, traders can preserve their capital and withstand market volatility.

Trend Following

- Trend following is a popular strategy in forex trading that involves identifying and riding prevailing market trends. Traders capitalize on upward or downward price movements by entering positions in the direction of the trend. Trend-following strategies utilize technical indicators such as moving averages and trendlines to confirm the direction of the trend and identify potential entry and exit points.

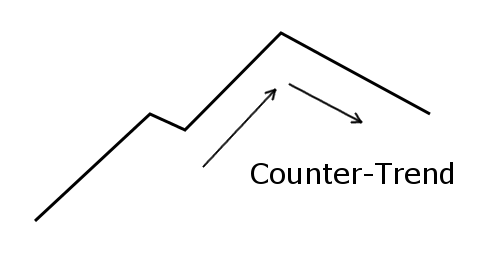

Counter-Trend Trading

- Contrary to trend-following strategies, counter-trend trading involves taking positions against the prevailing market trend. Traders identify overbought or oversold conditions in the market and anticipate reversals in price direction. Counter-trend traders rely on indicators such as oscillators and candlestick patterns to identify potential turning points in the market and capitalize on short-term price movements.

Key Takeaways

- 1. Forex trading through futures contracts offers ample opportunities for profit but requires a thorough understanding of market dynamics and effective trading strategies.

- 2. Technical analysis and fundamental analysis are two primary approaches used by traders to forecast market movements and identify trading opportunities.

- 3. Risk management is crucial in forex trading to protect capital and preserve long-term profitability. Traders should implement sound risk management techniques and adhere to disciplined trading practices.

- 4. Trend following and counter-trend trading are two common strategies employed by forex traders to capitalize on market trends and price reversals, respectively.