What is Algo Trading? A Beginner's Guide

- Algorithmic trading, commonly known as algo trading, is the process of using computer algorithms to automate trading decisions and execute trades. In the forex market, where currency pairs are traded, algo trading can significantly enhance efficiency, accuracy, and profitability. This type of trading leverages complex mathematical models and high-speed data analysis to make trades at speeds and frequencies that are impossible for human traders.

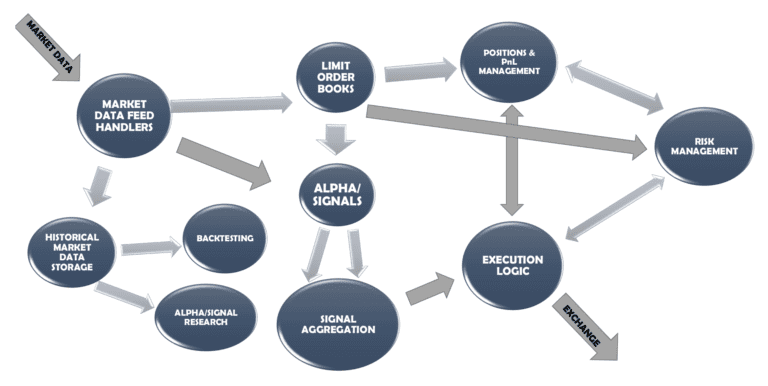

Key Components of an Algorithmic Trading System

An algorithmic trading system in forex consists of several key components:

1. Trading Strategy

- The backbone of any algo trading system. It outlines the rules and conditions under which trades are executed. Strategies can range from simple moving averages to complex machine learning models.

2. Algorithm

- This is the set of coded instructions that define the trading strategy. Algorithms can be written in various programming languages such as Python, C++, or Java.

3. Data Feed

- Real-time and historical market data are essential for the algorithm to make informed decisions. Data feeds provide information on currency prices, market volume, and other relevant metrics.

4. Execution System

- This is the mechanism that places the trades. It connects to forex brokers and exchanges, executing buy and sell orders as per the algorithm's instructions.

5. Risk Management System

- Integral to protecting capital, it includes stop-loss limits, position sizing rules, and other risk control measures.

6. Backtesting Environment

- Before deploying an algorithm in live markets, it must be tested against historical data to evaluate its performance and robustness.

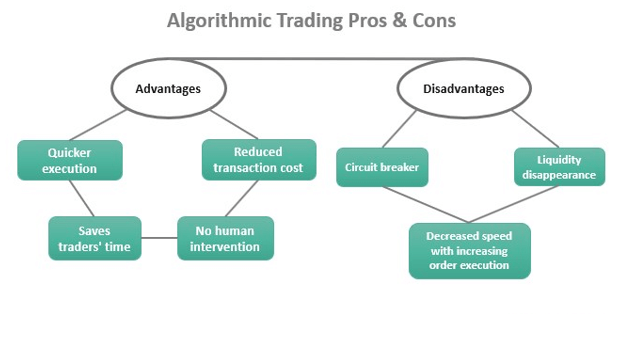

Advantages of Using Algo Trading in Forex

The advantages of algorithmic trading in the forex market are numerous:

1. Speed and Efficiency

- Algorithms can analyze market conditions and execute trades in milliseconds, much faster than any human can.

2. Precision

- Algo trading eliminates human errors caused by emotional and psychological factors, ensuring trades are executed exactly as planned.

3. Backtesting

- Traders can test their strategies on historical data to see how they would have performed, allowing for refinement and optimization before risking real money.

4. Consistency

- Algorithms follow their programmed rules without deviation, ensuring a consistent trading approach.

5. 24/7 Trading

- The forex market operates 24 hours a day, and algo trading systems can work around the clock without the need for breaks.

6. Diversification

- Algo trading allows for the simultaneous execution of multiple strategies across different currency pairs, spreading risk and increasing opportunities.

Examples of Popular Algo Trading Strategies

Several algo trading strategies are popular among forex traders:

1. Trend Following

- This strategy aims to capitalize on the momentum of market trends. It typically uses indicators like moving averages and the Relative Strength Index (RSI) to identify and follow trends.

2. Arbitrage

- This strategy seeks to exploit price discrepancies between different forex markets or currency pairs. Algorithms identify and act on these discrepancies quickly to lock in profits.

3. Mean Reversion

- Based on the idea that prices will revert to their historical averages, this strategy involves buying low and selling high, or selling high and buying low.

4. Scalping

- A high-frequency trading strategy that involves making dozens or hundreds of trades in a day to capture small price movements. Scalping requires highly efficient algorithms and data feeds.

5. Market Making

- This involves placing both buy and sell orders to profit from the spread between the bid and ask prices. Market makers provide liquidity to the market, earning profits from the difference.

Key Takeaways

- Algorithmic trading (algo trading) automates trading decisions and executions in the forex market using computer algorithms.

- Key components of an algo trading system include the trading strategy, algorithm, data feed, execution system, risk management system, and backtesting environment.

- Advantages of algo trading include speed, precision, backtesting capabilities, consistency, 24/7 trading, and diversification.

- Popular algo trading strategies in forex include trend following, arbitrage, mean reversion, scalping, and market making.