- Forex trading, the global marketplace for exchanging national currencies, is a dynamic and complex field that has seen a significant transformation with the advent of Artificial Intelligence (AI). AI's integration into forex trading has revolutionized the way traders analyze markets, make decisions, and execute trades. This article explores the critical role of AI in forex trading, focusing on AI-powered trading algorithms, the impact of machine learning on market analysis, real-time data processing, and the tools available for forex traders.

AI-Powered Trading Algorithms: How They Work

- AI-powered trading algorithms are at the heart of modern forex trading. These algorithms leverage vast amounts of historical and real-time market data to identify patterns and trends that human traders might miss. The core idea is to use AI to process data at a speed and accuracy far beyond human capabilities, thus enabling traders to make informed decisions quickly.

- These algorithms use techniques such as statistical analysis, sentiment analysis, and pattern recognition. By constantly learning from new data, they can adapt to changing market conditions, making them highly effective in predicting price movements. For example, an AI algorithm might analyze the historical price data of the EUR/USD currency pair, identify a recurring pattern before significant price movements, and use this pattern to inform future trades.

Machine Learning and Its Impact on Market Analysis

- Machine learning, a subset of AI, has profoundly impacted market analysis in forex trading. It involves training algorithms on historical data to make predictions about future market behavior. Machine learning models can analyze vast datasets, including economic indicators, news releases, and social media sentiment, to forecast currency price movements.

- The impact of machine learning on market analysis is evident in its ability to handle the complexity and non-linearity of financial markets. Unlike traditional statistical models, machine learning algorithms can uncover hidden relationships between different market factors, providing traders with deeper insights. For instance, a machine learning model might find that a specific economic indicator, such as the US Non-Farm Payrolls report, has a stronger correlation with the USD/JPY currency pair than previously thought.

Real-time Data Processing and Trade Execution

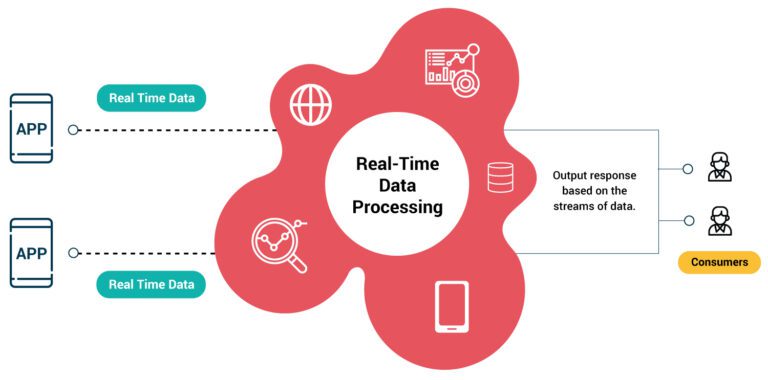

- One of the significant advantages of AI in forex trading is its ability to process real-time data and execute trades with minimal latency. Real-time data processing is crucial in the fast-paced forex market, where prices can change in milliseconds. AI systems can ingest and analyze data from multiple sources, such as market feeds, news outlets, and social media, almost instantaneously.

- Once the data is processed, AI can execute trades based on predefined criteria. This automation reduces the risk of human error and ensures that trades are executed at the optimal time. For example, if an AI system detects a sudden drop in the value of the Euro due to an unexpected political event, it can automatically execute a sell order to mitigate potential losses.

AI Tools Available for Forex Traders

- There are several AI tools available for forex traders, ranging from advanced trading platforms to sophisticated analytical tools. Some of the popular AI-powered platforms include:

1. MetaTrader 4/5

- These platforms offer advanced charting and analysis tools, as well as the ability to use custom AI algorithms for trading.

2. Trade Ideas

- An AI-powered stock scanner that helps traders find potential trading opportunities based on real-time data and historical patterns.

3. Kavout

- An AI-driven investment platform that uses machine learning to provide predictive analytics and trade recommendations.

4. AlgoTrader

- A comprehensive algorithmic trading platform that supports the development and execution of AI-powered trading strategies.

Key Takeaways

- Enhanced Decision Making: AI improves decision-making by analyzing vast amounts of data quickly and accurately.

Adaptability

- AI-powered algorithms can adapt to changing market conditions, providing a competitive edge.

Real-time Processing

- AI's ability to process real-time data ensures timely and precise trade execution.

Advanced Tools

- Various AI tools and platforms are available to assist traders in analyzing markets and executing trades effectively.

Reduced Human Error

- Automation in trade execution minimizes the risk of human errors, leading to more efficient trading.