- In the ever-evolving realm of cryptocurrency trading, stability is often seen as the holy grail amidst the tumultuous waves of volatility. Enter stablecoins - a class of cryptocurrencies designed to provide a reliable, stable store of value in an otherwise unpredictable market. In this article, we'll delve into the nuances of stablecoins trading, unraveling the intricacies of these stable-value cryptocurrencies.

What Are Stablecoins?

- Stablecoins are a subset of cryptocurrencies engineered to maintain a stable value by pegging it to external assets like fiat currencies, commodities, or other cryptocurrencies. Unlike their volatile counterparts such as Bitcoin or Ethereum, stablecoins offer a reliable means of transacting and storing value without the rollercoaster ride of price fluctuations.

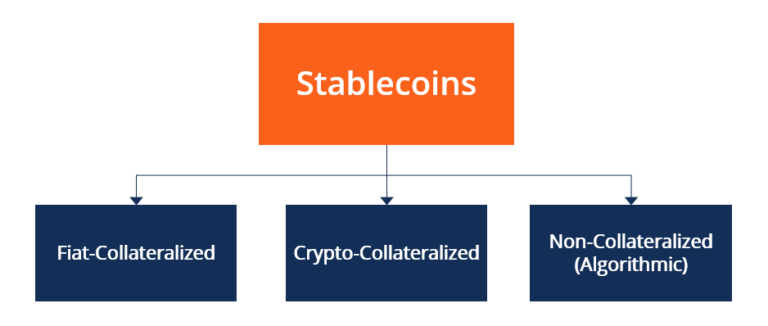

Types of Stablecoins

- There are several types of stablecoins, each with its own mechanism for maintaining stability:

Fiat-Collateralized Stablecoins

- Backed by reserves of fiat currency (e.g., USD, EUR), these stablecoins provide a direct link to real-world assets, offering stability akin to traditional currencies. Examples include Tether (USDT) and USD Coin (USDC).

Crypto-Collateralized Stablecoins

- These stablecoins are backed by a reserve of other cryptocurrencies, often over-collateralized to ensure stability. While they provide decentralization, they are still exposed to the inherent volatility of crypto markets. Dai (DAI) stands out as a prominent example in this category.

Algorithmic Stablecoins

- Operating on algorithms to adjust supply dynamically, algorithmic stablecoins seek to maintain stability without the need for collateral backing. However, they are subject to algorithmic risks and require careful monitoring. Terra (LUNA) and Ampleforth (AMPL) are notable examples.

Benefits of Stablecoins Trading

- Trading stablecoins offers a myriad of benefits for investors and traders alike:

Mitigating Volatility

- By providing a stable store of value, stablecoins shield traders from the wild price swings characteristic of traditional cryptocurrencies, enabling smoother transactions and portfolio management.

Seamless Cross-Border Transactions

- Stablecoins facilitate instant and low-cost cross-border transactions, eliminating the need for intermediaries and overcoming the barriers of traditional banking systems.

Risk Management

- Traders can use stablecoins as a hedging tool against market volatility, diversifying their portfolios and minimizing exposure to risk.

24/7 Accessibility

- Unlike traditional financial markets, stablecoin trading operates 24/7, offering traders greater flexibility and accessibility to global markets.

Understanding Stablecoins Trading: Key Considerations

- While trading stablecoins presents numerous opportunities, it's essential to approach it with caution and understanding. Here are some key considerations:

- Due Diligence: Conduct thorough research and due diligence before investing in any stablecoin, ensuring its credibility, stability mechanism, and regulatory compliance.

- Risk Management: Implement robust risk management strategies to safeguard your investments against unforeseen market fluctuations and operational risks.

- Regulatory Compliance: Stay abreast of regulatory developments and compliance requirements in your jurisdiction to ensure legal compliance and mitigate regulatory risks.

- Market Analysis: Continuously monitor market trends, liquidity conditions, and demand-supply dynamics to make informed trading decisions and capitalize on opportunities.