Introduction to Forex Trading

- forex trading, the global marketplace for exchanging currencies, operates 24/5, offering ample opportunities for traders to profit from fluctuations in exchange rates. In this dynamic arena, understanding the role of central banks is paramount for successful navigation and informed decision-making.

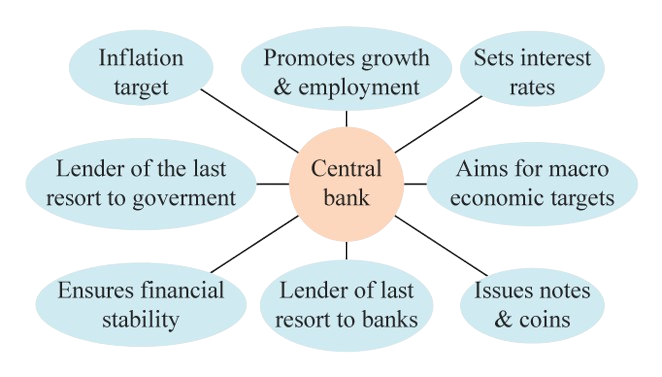

The Role of Central Banks

- Central banks, the monetary authorities of countries or regions, wield significant influence over currency values and exchange rates through various policy tools and interventions.

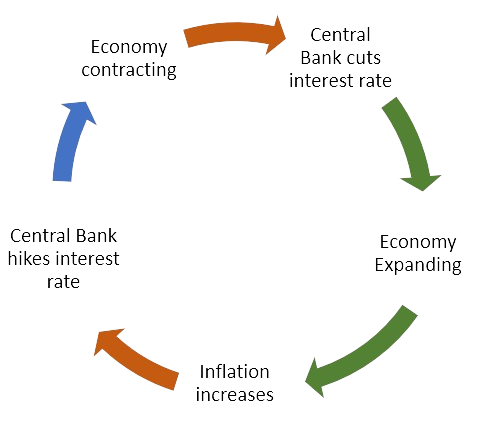

Interest Rate Management

- Central banks utilize interest rates as a primary tool to regulate economic activity and control inflation. Changes in interest rates can attract or repel foreign capital, impacting currency values accordingly.

Open Market Operations

- Through open market operations, central banks buy or sell government securities to adjust the money supply and influence interest rates. These actions can sway market sentiment and affect exchange rates.

Impact of Central Bank Announcements

- Central bank announcements and policy decisions are closely monitored by forex traders globally. Even subtle changes in language or tone during meetings can trigger significant movements in currency markets.

Key Takeaways for Forex Traders

- 1. Stay Informed: Regularly monitor central bank announcements, policy decisions, and economic indicators to anticipate market movements and adjust trading strategies accordingly.

- 2. Monitor Interest Ratest: Changes in interest rates signal shifts in monetary policy and can significantly impact currency values. Pay close attention to central bank statements regarding interest rate decisions and future guidance.

- 3. Watch for Intervention: Central bank interventions in the forex market can disrupt trends and influence short-term price movements. Keep an eye out for signs of intervention, such as large-scale currency purchases or verbal statements from central bank officials.

- 4. Diversify Risk: Forex trading carries inherent risks, including volatility and sudden market shifts. Mitigate risk by diversifying your trading portfolio across different currency pairs and asset classes.

- 5. Stay Flexible: Adapt your trading strategies to changing market conditions and central bank policies. Remain open to adjusting positions and risk management approaches in response to new information and developments.