- In the ever-evolving landscape of financial markets, forex trading stands out as one of the most dynamic and potentially lucrative arenas for investors. With its round-the-clock nature and high liquidity, forex offers ample opportunities for traders to capitalize on fluctuations in currency prices. However, success in forex trading demands more than just luck; it requires a deep understanding of market dynamics and effective strategies to navigate the complexities of the forex market.

Understanding Forex Trading

- Forex, short for foreign exchange, involves the buying and selling of currencies. Traders aim to profit from changes in exchange rates between different currencies. Unlike stock trading, forex operates 24 hours a day, five days a week, providing traders with constant opportunities to enter and exit positions.

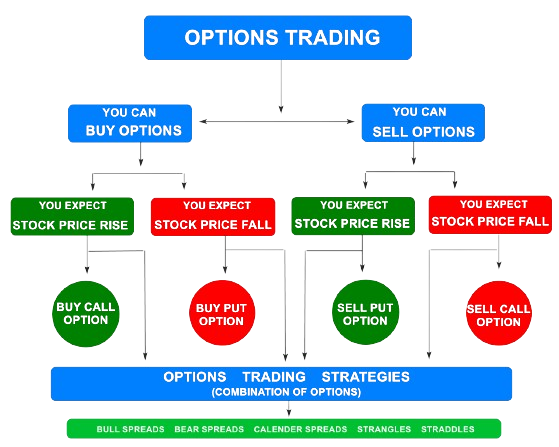

Options Trading Strategies

- Options trading is a derivative strategy that involves buying and selling options contracts based on the value of underlying assets such as currencies. Here are some key options trading strategies for profitable returns in forex:

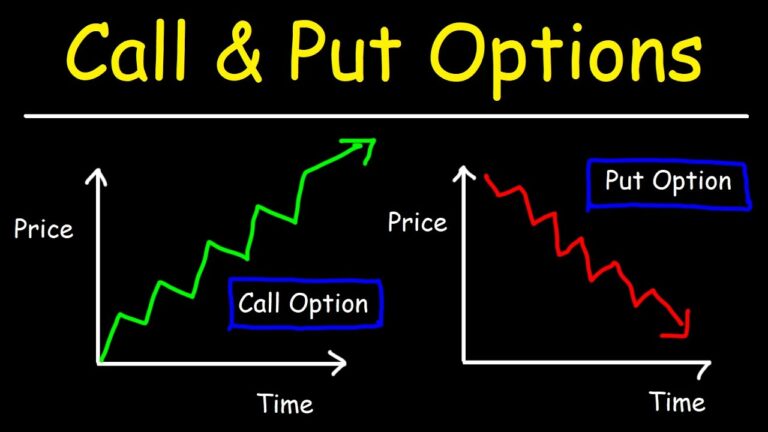

1. Call and Put Options

- Call options give traders the right to buy a currency pair at a specified price within a certain timeframe, while put options give traders the right to sell a currency pair at a specified price within a certain timeframe. By purchasing call options on a currency pair expected to appreciate or put options on a currency pair expected to depreciate, traders can profit from price movements without owning the underlying asset.

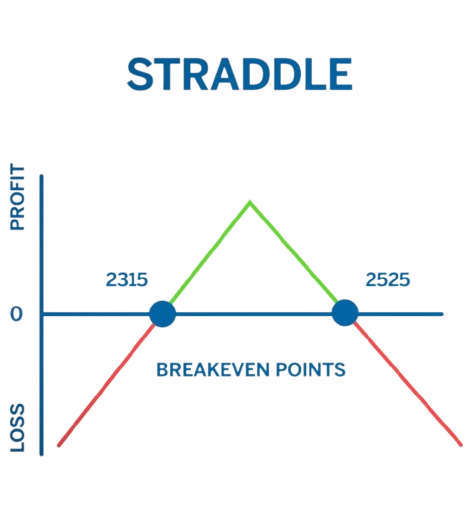

2. Straddle Strategy

- The straddle strategy involves buying both a call option and a put option on the same currency pair with the same expiration date and strike price. This strategy is effective when traders expect significant price volatility but are unsure about the direction of the movement. Profits can be realized if the currency's price moves significantly in either direction, surpassing the breakeven points.

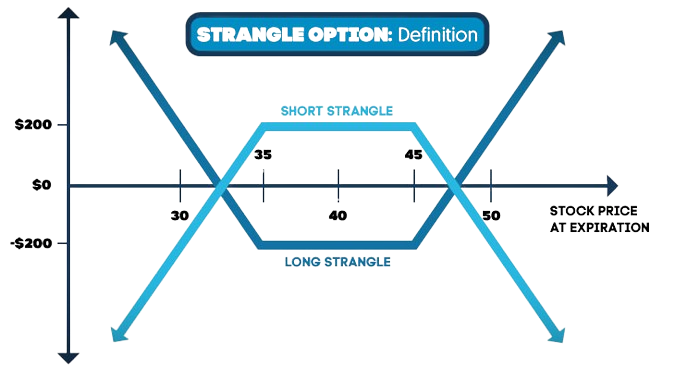

3. Strangle Strategy

- Similar to the straddle strategy, the strangle strategy involves buying both a call option and a put option on the same currency pair. However, the strike prices of the options are typically set at different levels, allowing traders to capitalize on price volatility while reducing the cost of the options. Profits are realized if the currency's price moves beyond the breakeven points.

4. Covered Call Strategy

- In the covered call strategy, traders who own the underlying currency pair sell call options against their holdings. If the price of the currency remains below the strike price of the call option, the trader keeps the premium received from selling the option. However, if the price surpasses the strike price, the trader may be obligated to sell the currency pair at a predetermined price, limiting potential profits.

Key Takeaways

- 1. Risk Management: Effective risk management is essential in forex trading. Traders should carefully consider their risk tolerance and use stop-loss orders to limit potential losses.

- 2.Diversification: Diversifying your portfolio across different currency pairs can help spread risk and maximize opportunities for profit.

- 3. Continuous Learning: The forex market is constantly evolving, and successful traders stay informed about market trends, economic indicators, and geopolitical events that can impact currency prices.

- 4. Discipline and Patience : Forex trading requires discipline and patience. Traders should stick to their trading plans and avoid emotional decision-making.

- 5. Utilize Technology : Leveraging trading platforms, technical analysis tools, and automated trading systems can enhance efficiency and accuracy in forex trading.