- In the dynamic world of finance, Forex trading stands out as one of the most exhilarating and potentially lucrative endeavors. With its 24/7 market and vast trading volume, Forex offers endless opportunities for traders worldwide. However, along with the promise of profits comes the inherent risk of losses. To navigate this volatile terrain successfully, mastering risk management techniques is paramount.

Understanding Risk Management in Forex Trading

- Forex trading involves speculating on the exchange rate between two currencies. As prices fluctuate rapidly, traders must adopt robust risk management strategies to protect their capital. Here are some key techniques every trader should employ:

1. Set Stop Losses

- Implementing stop-loss orders is fundamental in limiting potential losses. A stop-loss order allows traders to specify the maximum amount they are willing to lose on a particular trade. By setting a predetermined exit point, traders can mitigate the risk of significant losses in volatile market conditions.

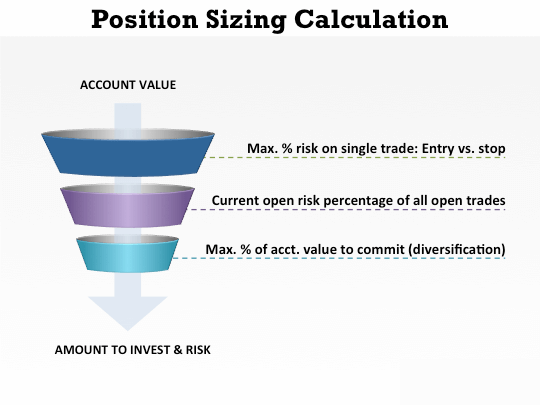

2. Proper Position Sizing

- Determining the appropriate position size is crucial for managing risk effectively. Traders should calculate the ideal position size based on their account size, risk tolerance, and the distance to the stop-loss level. By allocating a reasonable portion of their capital to each trade, traders can minimize the impact of adverse market movements.

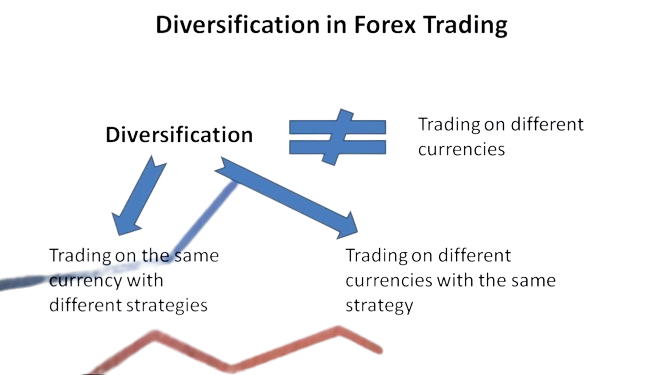

3. Diversification

- Diversifying across multiple currency pairs can help spread risk and reduce the correlation between trades. By avoiding overexposure to any single currency or market event, traders can safeguard their portfolios against unexpected developments and mitigate the impact of adverse price movements.

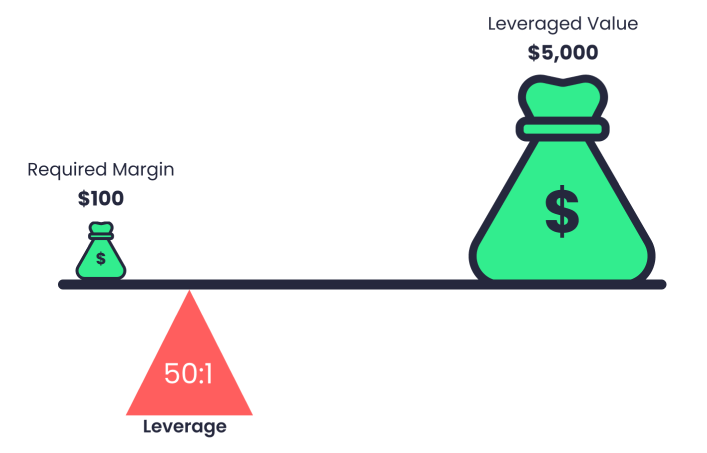

4. Use Leverage Wisely

- While leverage can amplify returns, it also magnifies losses. Therefore, it is essential to use leverage judiciously and be mindful of its potential risks. Traders should carefully assess their risk appetite and only utilize leverage that aligns with their trading strategy and financial goals.

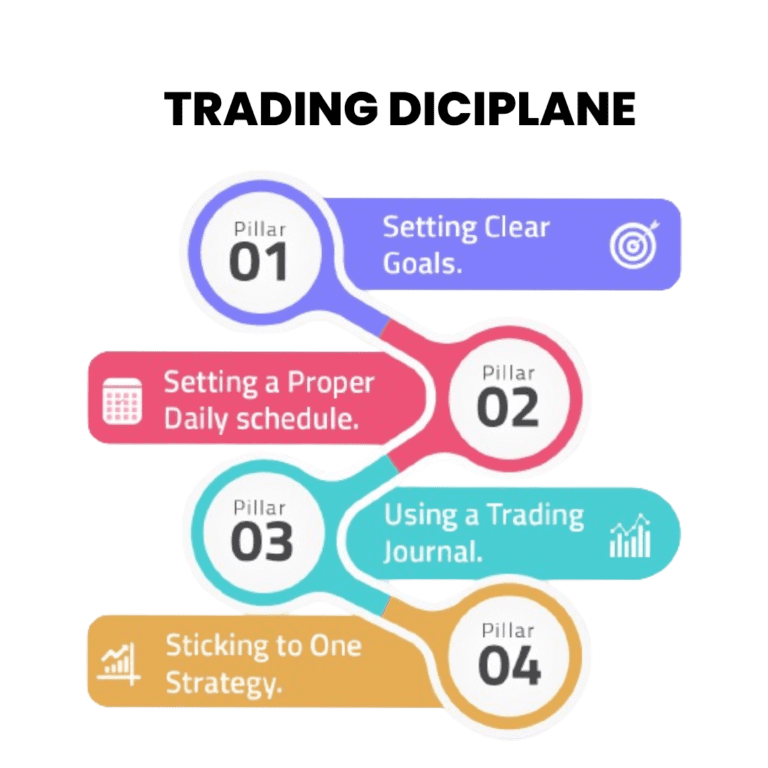

5. Maintain Disciplined Trading

- Emotional discipline is paramount in Forex trading. Fear and greed can cloud judgment and lead to impulsive decision-making, which often results in significant losses. By adhering to a well-defined trading plan and sticking to pre-established risk management rules, traders can maintain composure and avoid irrational behavior.

Key Takeaways

- 1. Prioritize Capital Preservation: In Forex trading, protecting capital should always take precedence over pursuing profits. By implementing robust risk management techniques, traders can safeguard their capital and maintain longevity in the market.

- 2. Embrace Volatility with Caution: While volatility presents opportunities for profit, it also carries inherent risks. Traders should approach volatile markets with caution and employ prudent risk management strategies to mitigate potential losses.

- 3. Education is Key: Continuous learning and staying informed about market developments are essential for successful Forex trading. Traders should invest time in educating themselves about various risk management techniques and constantly refine their skills to adapt to changing market conditions.

- 4. Patience and Discipline Pay Off : Successful Forex trading requires patience, discipline, and emotional resilience. By exercising restraint and adhering to a disciplined trading approach, traders can navigate the complexities of the market with confidence and consistency.