- Forex trading involves analyzing vast amounts of data and making quick decisions, often within seconds. Traditional methods struggle to keep up with the volume, speed, and complexity of the market. AI, with its ability to process large datasets and identify patterns beyond human capability, becomes invaluable. AI-driven systems can analyze historical data, news events, and market trends in real-time, providing traders with deeper insights and more accurate predictions.

Enhancing Decision-Making with AI

- AI enhances decision-making by providing traders with robust analytical tools. Machine learning algorithms can learn from past market behaviors and predict future trends, helping traders make informed decisions. For instance, AI can identify trading signals and suggest optimal entry and exit points for trades. Additionally, AI systems can continuously update and improve their models based on new data, ensuring that traders always have access to the most current and relevant information.

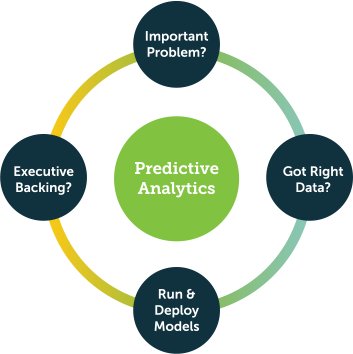

Predictive Analytics: How AI Forecasts Market Movements

- Predictive analytics is one of the most powerful applications of AI in forex trading. By analyzing historical price data, volume, and other market indicators, AI can forecast potential market movements. These predictions are based on sophisticated algorithms that identify patterns and correlations invisible to the human eye. For example, AI can detect subtle changes in market sentiment or the impact of geopolitical events on currency values, allowing traders to anticipate market shifts before they occur.

Reducing Emotional Bias in Trading

- Emotional bias is a common pitfall for traders, leading to impulsive decisions and significant losses. Fear and greed can cloud judgment, resulting in poor trading choices. AI mitigates this risk by making decisions based purely on data and logic, devoid of emotional interference. Automated trading systems powered by AI can execute trades with precision and consistency, ensuring that decisions are made rationally and objectively.

Case Studies: Success Stories of AI in Forex Trading

- The success of AI in Forex trading is evidenced by several case studies. For instance, a major financial institution implemented an AI-driven trading platform that resulted in a 20% increase in trading accuracy and a 15% reduction in operational costs. Another example is a hedge fund that utilized AI for its trading strategies, achieving a remarkable annual return of 30%, significantly outperforming traditional trading methods.

- A retail Forex trader, leveraging AI tools, managed to transform a modest investment into a substantial portfolio within a year. By using AI to analyze market trends and execute trades, the trader minimized losses and capitalized on profitable opportunities more effectively than relying on manual trading.

Key Takeaways

- AI Enhances Decision-Making : AI algorithms provide precise, data-driven insights that improve trading strategies and outcomes.

- Predictive Analytics : AI forecasts market movements accurately, giving traders a competitive edge.

- Reduction of Emotional Bias : AI-driven trading systems maintain objectivity, mitigating the negative impacts of human emotions on trading decisions.

- Proven Success: Real-world case studies demonstrate the significant benefits of integrating AI into Forex trading, from increased returns to cost reductions.