- Forex trading, the exchange of currencies on the global market, offers opportunities for substantial profits but also carries significant risks. Success in this dynamic market hinges on a well-crafted trading plan. Here's how to create a winning strategy that can help you navigate the complexities of forex trading.

Understanding Forex Trading

- Before diving into the specifics of a trading plan, it's essential to understand the basics of forex trading. The forex market operates 24 hours a day, five days a week, allowing traders to buy, sell, and speculate on currency pairs. The major pairs include EUR/USD, USD/JPY, GBP/USD, and USD/CHF, among others. Trading these pairs involves predicting how one currency will perform against another based on economic indicators, geopolitical events, and market sentiment.

Steps to Create a Winning Trading Plan

1. Set Clear Objectives

- Begin by defining your trading goals. Are you aiming for short-term gains, or are you looking to build a long-term investment portfolio? Your objectives should be realistic, measurable, and aligned with your risk tolerance.

2. Conduct Thorough Research

- Knowledge is power in forex trading. Stay informed about global economic news, central bank policies, and market trends. Utilize resources like financial news websites, forex forums, and economic calendars to stay updated.

3. Choose a Trading Style

- Your trading style should match your personality and lifestyle. Common styles include day trading, swing trading, and position trading. Day trading involves making multiple trades within a single day, while swing trading spans several days or weeks, and position trading can last for months or even years.

4. Develop a Risk Management Strategy

- Risk management is crucial to protect your capital. Determine how much of your portfolio you are willing to risk on a single trade. A common rule of thumb is to risk no more than 1-2% of your capital per trade. Use stop-loss orders to automatically close trades that move against you, limiting potential losses.

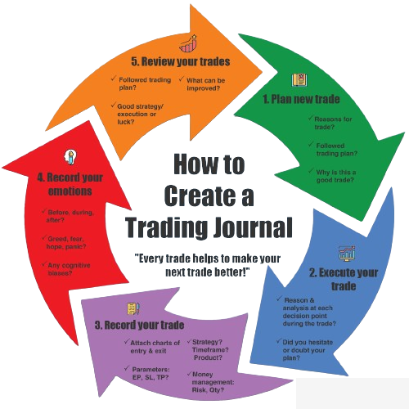

5. Create a Trading Journal

- Keeping a detailed trading journal helps you track your trades, analyze performance, and learn from your mistakes. Record entry and exit points, trade sizes, the rationale behind each trade, and the outcome.

6. Backtest Your Strategy

- Before implementing your trading plan, backtest it using historical data. This process involves applying your strategy to past market conditions to see how it would have performed. Backtesting helps identify potential flaws and refine your approach.

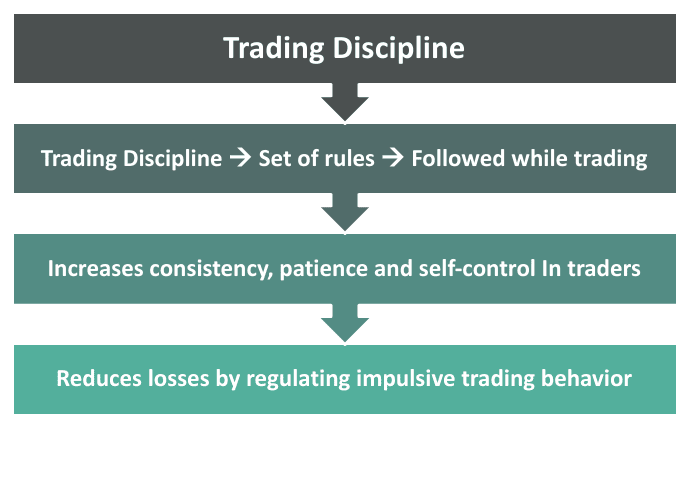

7. Stay Disciplined

- Discipline is key to sticking to your trading plan. Avoid emotional trading decisions based on fear or greed. Adhere to your strategy and make adjustments based on rational analysis, not impulse.

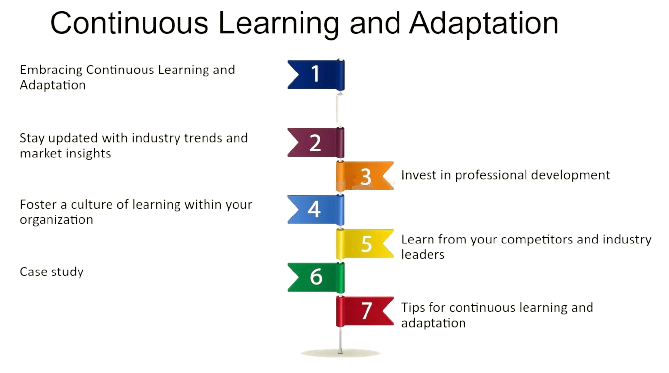

8. Continuous Learning and Adaptation

- The forex market is ever-changing, and so should be your trading plan. Regularly review your performance, stay informed about market developments, and be willing to adapt your strategy as needed.

Key Takeaways

- Set Clear and Achievable Goals : Define what you want to achieve with your forex trading and set realistic targets.

- Stay Informed : Keep up with global economic news and market trends to make informed trading decisions.

- Choose a Suitable Trading Style : Match your trading style with your personality and available time.

- Implement Robust Risk Management : Protect your capital by limiting the amount you risk on each trade and using stop-loss orders.

- Maintain a Trading Journal : Track your trades meticulously to identify patterns and areas for improvement.

- Backtest Your Strategy : Use historical data to test and refine your trading plan before committing real capital.

- Maintain Discipline : Stick to your trading plan and avoid emotional decision-making.

- Be Adaptive : Continuously learn and adapt your strategy to stay aligned with market conditions.