- Forex trading, the exchange of one currency for another, remains one of the largest and most dynamic markets in the world. With a daily trading volume exceeding $6 trillion, it attracts investors of all sizes, from large financial institutions to individual traders. As we look ahead to 2024, several trends are poised to shape the future of forex trading. These developments offer both opportunities and challenges, making it crucial for traders to stay informed and adapt their strategies accordingly.

1. Technological Advancements and AI Integration

- One of the most significant trends in forex trading is the integration of advanced technologies, particularly artificial intelligence (AI) and machine learning. These technologies are transforming how traders analyze markets, make predictions, and execute trades. AI-driven algorithms can process vast amounts of data at unprecedented speeds, identifying patterns and trends that might be invisible to human traders.

- In 2024, expect to see more trading platforms incorporating AI to provide enhanced analytics and decision-making tools. These platforms will offer features like automated trading, where AI systems execute trades based on predefined criteria, reducing the emotional bias and human error that often lead to poor trading decisions.

2. Increased Use of Blockchain and Cryptocurrencies

- Blockchain technology and cryptocurrencies are increasingly influencing the forex market. Blockchain provides a transparent and secure method for recording transactions, which can enhance the integrity of forex trading. Additionally, the rise of digital currencies offers new trading pairs and opportunities for traders.

- Cryptocurrencies like Bitcoin and Ethereum are becoming more integrated into the global financial system. In 2024, we can expect more forex brokers to offer cryptocurrency trading, allowing traders to speculate on the price movements of these digital assets alongside traditional currencies.

3. Enhanced Regulation and Compliance

- Regulatory frameworks around the world are tightening, aiming to increase transparency and protect traders from fraud. While increased regulation can pose challenges for brokers, it also offers a safer trading environment for participants.

- In 2024, new regulations will likely focus on areas such as anti-money laundering (AML) practices, data protection, and ensuring fair trading practices. Traders should stay informed about these regulatory changes, as non-compliance can lead to significant penalties and restrictions.

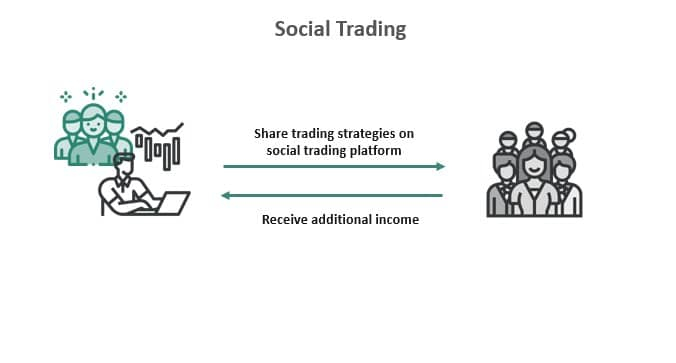

4. Growing Popularity of Social Trading

- Social trading, where traders share their strategies and copy the trades of successful investors, is gaining traction. Platforms like eToro have popularized this concept, making forex trading more accessible to beginners.

- In 2024, social trading is expected to grow further, driven by advancements in social media and online communities. Traders can benefit from shared knowledge and insights, reducing the learning curve and enhancing their trading performance.

5. Rise of Mobile Trading

- The convenience of mobile trading apps cannot be overstated. With smartphones becoming more powerful, traders can now execute trades, monitor markets, and manage their accounts on the go. This trend is set to continue, with trading platforms enhancing their mobile offerings to provide seamless, real-time trading experiences.

- In 2024, expect to see more sophisticated mobile trading applications with features such as voice-activated trading, enhanced security measures, and better user interfaces.

6. Focus on Education and Training

- As the forex market evolves, the need for education and training becomes paramount. Many brokers are now offering comprehensive educational resources, including webinars, tutorials, and interactive courses.

- In 2024, the emphasis on trader education will intensify, with a focus on helping traders understand new technologies, regulatory changes, and advanced trading strategies. This will empower traders to make informed decisions and stay competitive in the market.

Key Takeaways

- AI and Machine Learning : The integration of AI and machine learning in trading platforms is enhancing market analysis and automated trading.

- Blockchain and Cryptocurrencies : These technologies are providing new opportunities and increasing the transparency of forex transactions.

- Regulation and Compliance : Stricter regulations aim to protect traders and ensure market integrity.

- Social Trading : The growing popularity of social trading platforms is making forex trading more accessible.

- Mobile Trading : Enhanced mobile trading apps are offering more convenient and efficient trading experiences.

- Education and Training : Continuous learning is essential to keep up with market changes and new technologies.