- In the fast-paced world of Forex trading, where currencies fluctuate with the pulse of global events, understanding market sentiment is akin to wielding a powerful compass in a turbulent sea. It's a skill that transcends charts and data points, offering traders a deeper insight into the collective psyche of the market. This article explores the art and science of market sentiment analysis and its pivotal role in predicting trends in trading.

Deciphering Market Sentiment

- Market sentiment, often described as the mood or attitude of traders, encapsulates the prevailing emotions driving buying and selling decisions. It's a complex interplay of optimism, fear, greed, and uncertainty that shapes the trajectory of currency pairs. While fundamental and technical analysis provide fundamental insights, market sentiment offers a nuanced understanding of the underlying dynamics at play.

The Power of Predicting Trends

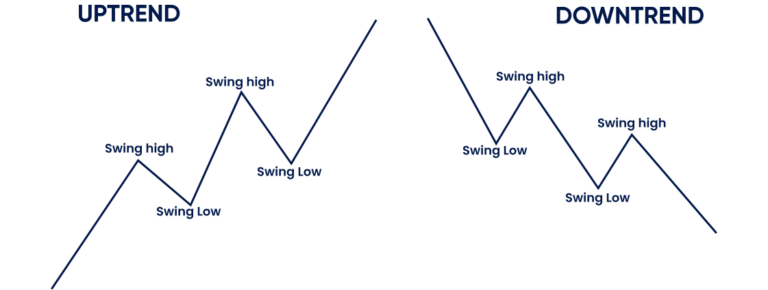

1. Identifying Trend Shifts

- Market sentiment analysis empowers traders to identify shifts in market sentiment before they materialize into tangible trends. By discerning early signs of bullish or bearish sentiment, traders can position themselves strategically to capitalize on emerging opportunities or mitigate potential risks.

2. Navigating Volatility

- In volatile market conditions, where prices oscillate with alarming frequency, market sentiment serves as a guiding light. By gauging the prevailing sentiment, traders can anticipate potential price movements and adjust their strategies accordingly, thereby minimizing losses and maximizing profits.

3. Reacting to News Events

- News events serve as catalysts for market sentiment shifts. Economic data releases, central bank announcements, geopolitical tensions, and unexpected developments can trigger abrupt changes in sentiment, leading to sharp price fluctuations. Traders who remain vigilant and react swiftly to such events stand a better chance of navigating market volatility and capitalizing on price movements.

Tools of the Trade

1.Sentiment Indicators

- A plethora of tools and indicators help quantify market sentiment. The Commitments of Traders (COT) report provides insights into the positioning of institutional traders, while sentiment analysis tools like the Fear and Greed Index offer snapshots of market sentiment extremes. By leveraging these tools, traders can gain a deeper understanding of market sentiment and make more informed trading decisions.

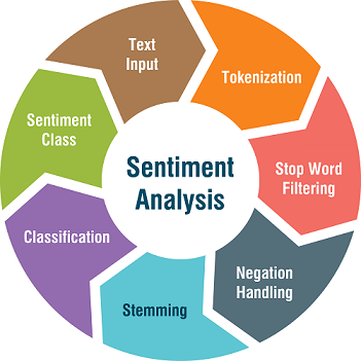

2. Social Media and Sentiment Analysis

- The advent of social media has revolutionized market sentiment analysis. Platforms like Twitter, Reddit, and financial forums serve as breeding grounds for market chatter and sentiment expression. Sentiment analysis algorithms sift through this vast trove of data, extracting valuable insights into the prevailing sentiment and its potential impact on price movements.

Key Takeaways for Forex Traders

- 1. Stay Informed : Keeping abreast of economic news, geopolitical developments, and market sentiment indicators is paramount for successful trading.

- 2. Balance Fundamentals with Sentiment : While fundamental analysis provides a solid foundation for trading decisions, integrating market sentiment analysis adds depth and nuance to trading strategies.

- 3. Adaptability is Key : Market sentiment can change rapidly in response to news events and evolving market dynamics. Traders must remain adaptable and agile, ready to adjust their strategies in real-time to capitalize on emerging opportunities or mitigate potential risks.

- 4. Risk Management : Effective risk management is essential in Forex trading. Setting stop-loss orders, diversifying portfolios, and managing position sizes help mitigate potential losses and safeguard capital in volatile market conditions.