- In the world of finance, Forex trading stands as a beacon of opportunity, offering the potential for lucrative returns to those who understand its intricacies. Yet, as technology advances, so too does the landscape of trading. In the era of big data, algorithms have become a driving force behind decision-making processes, reshaping the way Forex markets operate. Let's delve into the realm of algorithmic trading and its impact on Forex, exploring key takeaways for both seasoned traders and newcomers alike.

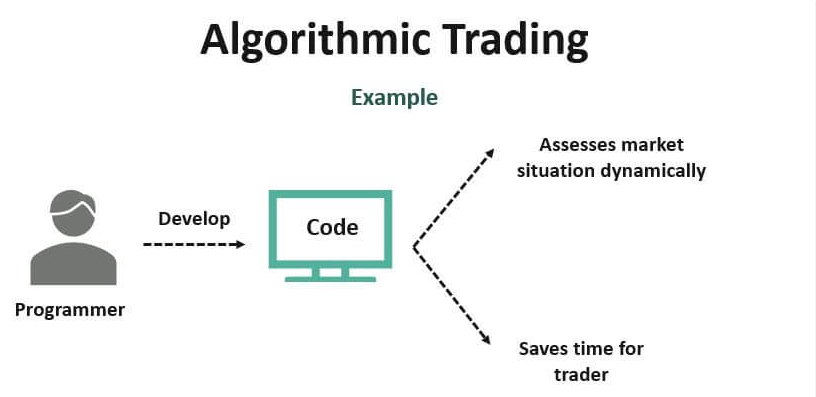

Algorithmic Trading Unveiled

- Algorithmic trading, also known as algo-trading or automated trading, involves the use of computer programs to execute trading strategies with precision and speed. These algorithms analyze vast amounts of data, including market trends, economic indicators, and historical price movements, to make informed trading decisions in milliseconds.

- The allure of algorithmic trading lies in its ability to eliminate human emotions from the equation, thereby reducing the risk of impulsive or irrational trading decisions. Instead, algorithms rely on logic and statistical analysis to identify profitable opportunities and execute trades with minimal human intervention.

The Role of Big Data

- At the heart of algorithmic trading lies big data – the vast and ever-expanding pool of information generated by various sources, including social media, news outlets, and financial reports. Big data provides traders with a wealth of information to inform their strategies, allowing them to identify patterns, correlations, and anomalies that may influence market movements.

- By harnessing the power of big data, traders can gain valuable insights into market sentiment, investor behavior, and macroeconomic trends, enabling them to make more informed trading decisions. Moreover, advancements in technology have made it possible to process and analyze big data in real-time, giving traders a competitive edge in rapidly changing markets.

Key Takeaways for Forex Traders

- For Forex traders, understanding the implications of algorithmic trading and big data is crucial for navigating the complexities of the market effectively. Here are some key takeaways to consider:

1. Embrace Automation

- Embracing algorithmic trading can enhance efficiency and accuracy in executing trades, allowing traders to capitalize on opportunities that may arise within fractions of a second.

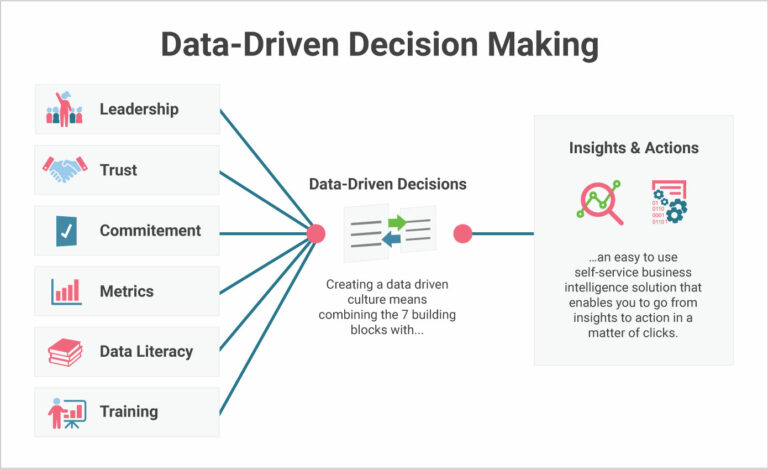

2. Data-Driven Decision Making

- Incorporating big data analytics into trading strategies can provide valuable insights into market dynamics and trends, empowering traders to make informed decisions based on objective analysis rather than speculation.

3. Risk Management

- While algorithmic trading can offer significant benefits, it's essential to implement robust risk management protocols to mitigate potential losses. This includes setting predefined risk parameters, diversifying trading strategies, and regularly monitoring performance metrics.

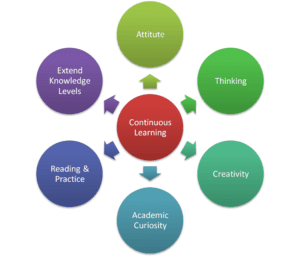

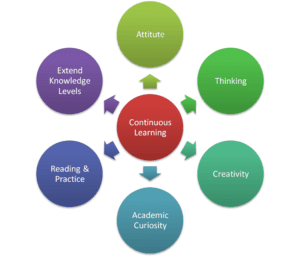

4. Continuous Learning

- The landscape of Forex trading is constantly evolving, driven by advancements in technology and changes in market conditions. Therefore, it's essential for traders to stay abreast of emerging trends, tools, and techniques through continuous learning and education.

5. Adaptability

- Flexibility is key in the world of Forex trading. Traders must be willing to adapt their strategies in response to shifting market dynamics, regulatory changes, and technological innovations to remain competitive.